Risk professionals know this scenario well. Your team spends weeks preparing the quarterly risk assessment. By the time it reaches the board, two new regulatory compliance requirements have dropped, a cyber incident at a peer company has shifted your risk profile, and the report is already outdated.

Meanwhile, your spreadsheet-based risk register can't keep pace with regulatory changes across multiple jurisdictions. Competitors identify emerging threats in days while your team is still compiling last quarter's data. The gap between risk velocity and your assessment cycle keeps widening.

AI in enterprise risk management addresses this fundamental challenge by transforming reactive compliance processes into continuous intelligence systems.

Organizations implementing AI-powered platforms identify emerging threats before they escalate, deploy professional ERM frameworks in days rather than months, and provide boards with real-time risk intelligence that actually informs decisions.

This guide explains how AI transforms enterprise risk management, covering:

AI transforms enterprise risk management by providing continuous, automated risk intelligence that replaces periodic manual assessments. The technology enables organizations to identify emerging threats in real-time, assess risks across 100% of data rather than samples, and deploy professional ERM frameworks in days instead of months.

Key applications include:

This continuous oversight model addresses the fundamental limitation of traditional ERM — quarterly assessment cycles that create blind spots in fast-moving risk environments.

Organizations gain comprehensive risk coverage without proportional headcount increases while providing boards with current intelligence that supports strategic decisions rather than historical summaries.

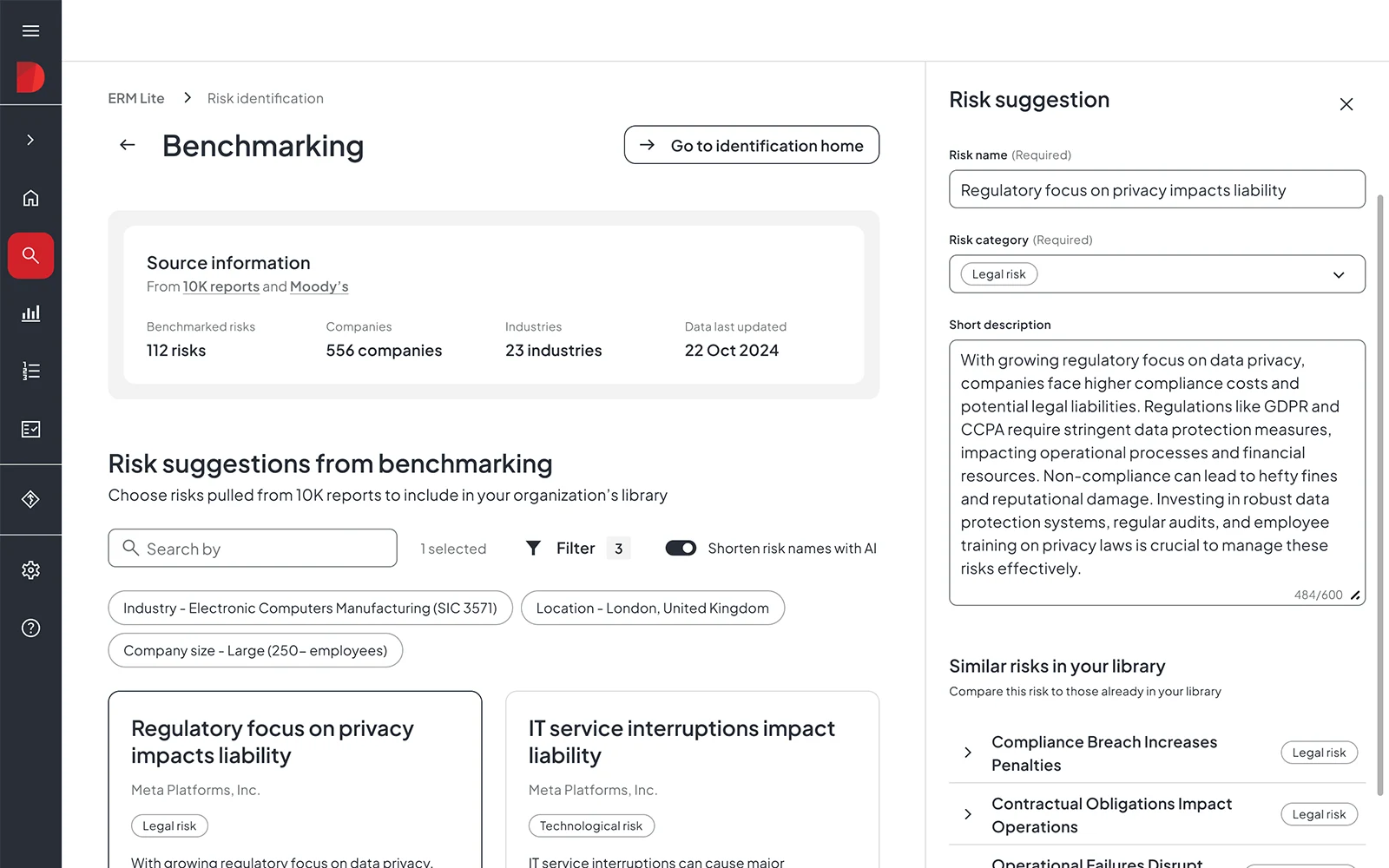

AI scans thousands of public company disclosures to identify risks relevant to specific industries and business models. Rather than starting with blank spreadsheets, organizations access AI-powered benchmarking that surfaces risks from thousands of real-world examples.

This capability proves particularly valuable for companies establishing first-time ERM programs or entering new markets. AI algorithms analyze peer disclosures to identify industry-specific threats, emerging risk categories and risk language that satisfy investor and regulator expectations.

"It's a solution that was properly priced, quick to deploy, and simple to learn — enhancing our enterprise risk management program and delivering immediate value to all stakeholders," says Melanie McGrath, General Counsel at CBCL Limited, describing her experience implementing AI-powered risk identification.

Traditional risk management operated on quarterly or annual cycles, creating gaps where threats escalate undetected between assessment periods. AI enables continuous risk monitoring through automated data feeds from financial systems, operational databases, cybersecurity platforms and external threat intelligence.

Platforms analyze transactions in real-time, flag threshold breaches automatically and provide executive alerts when risk indicators exceed predetermined parameters. This shift from periodic snapshots to continuous oversight fundamentally changes how organizations manage uncertainty.

Machine learning algorithms analyze historical risk data, external market indicators and operational metrics to identify patterns that signal emerging threats. On the other hand, predictive models forecast risk likelihood and potential impact based on factors that precede similar incidents in the organization's history or industry.

These capabilities prove essential for organizations managing complex, interconnected risks where traditional assessment methods struggle to identify correlations across business units, geographies and risk domains.

AI surfaces relationships between operational risks, financial exposures and regulatory requirements that manual processes typically miss.

Natural language processing enhances predictive capabilities by analyzing regulatory announcements, industry news and competitor disclosures. This allows it to identify trends that may affect the organization's risk profile before regulatory changes take effect or market conditions deteriorate.

AI automates risk scoring by analyzing multiple data inputs simultaneously — historical incident data, control effectiveness metrics, external threat intelligence and operational performance indicators. Machine learning algorithms continuously refine scoring accuracy as new data becomes available, eliminating manual recalibration requirements.

"There needs to be collaboration between risk and the business, vertically up and down but then also horizontally across the organization. It is absolutely essential — collaboration across risk departments. The problem is there are silos. Risk and audit are interconnected and interdependent," says Michael Rasmussen, CEO of GRC Report.

AI-powered risk assessment bridges these silos by correlating data across departments and risk categories. Platforms identify where single incidents create exposure across multiple risk domains, enabling organizations to develop integrated response strategies rather than managing risks in isolation.

Organizations traditionally spent months working with consultants to establish ERM frameworks, develop risk taxonomies and implement assessment processes. AI-powered platforms compress this timeline to as little as 7 days through pre-built templates, automated workflows and intelligent guidance.

"Keep it practical. Keep the ERM program practically designed and not overly complex, through the entire lifecycle of the ERM process. High, medium, low are good enough. Keep your presentations to the board simple. Demonstrate practicality throughout the entire process," advises Maurice L. Crescenzi, Jr., Industry Practice Leader at Moody's.

AI enables this practical approach by automating routine tasks like risk data collection, assessment workflows and report generation while focusing human expertise on strategic risk response and stakeholder communication.

The rapid deployment capability is critical for pre-IPO companies demonstrating governance maturity during transaction-readiness periods or for newly acquired subsidiaries requiring immediate risk framework integration.

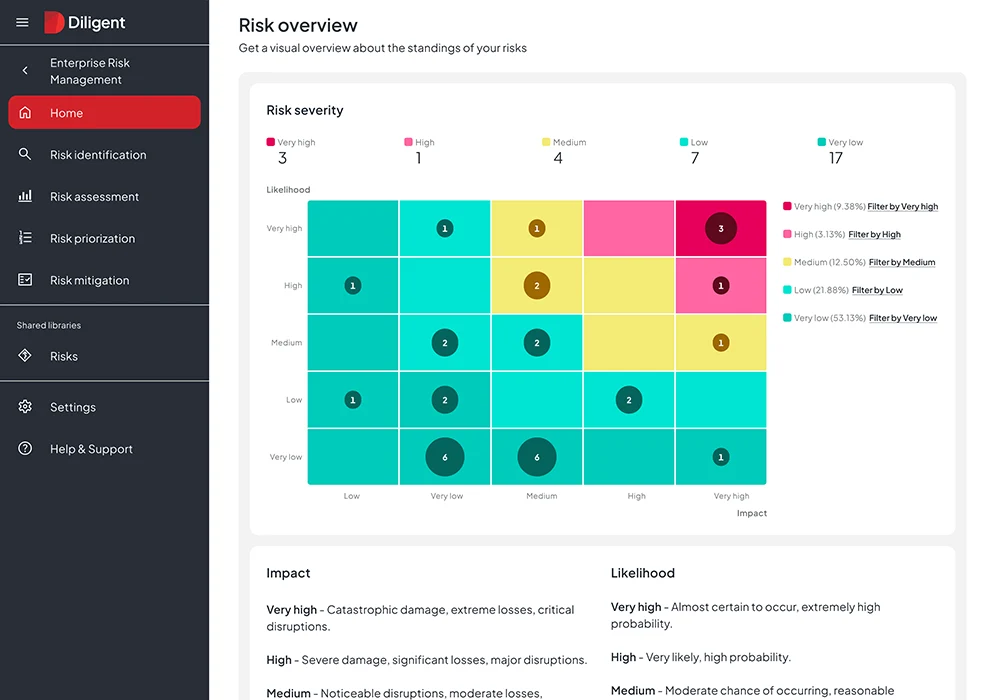

AI transforms complex risk data into executive-ready visualizations, trend analysis and predictive insights that support board decision-making. Automated reporting capabilities generate professional risk committee materials directly from platform data, reducing preparation time from days to hours.

"[Visuals are] very important. When we started our ERM journey, we weren't set for it, nor did we have in-house expertise. Everyone had their own idea of risk. We worked on an assessment and internal calibration effort to educate people about what we meant about the implications of the word 'risk.' The first presentation was, 'Here are some risks.' We put up a heatmap and I could feel the board's sigh of relief. A heatmap is a communication tool," explains Inna Barmash, Chief Legal Officer & Corporate Secretary at Amplify.

AI implementation success depends on matching platform capabilities to your organization's ERM maturity level.

Companies establishing first-time risk programs need rapid deployment and guided workflows that don't require specialized expertise.

On the other hand, organizations with existing ERM frameworks need integration capabilities and advanced analytics that enhance current processes. Both face the challenge of governing AI itself as a risk while deploying it to manage other risks.

Companies launching risk management programs face the challenge of building credible frameworks quickly without extensive internal expertise or consultant dependency.

According to Diligent Institute's What Directors Think 2025 report, 42% of directors see potential in AI to optimize operations and enhance workforce productivity. However, 32% cite a lack of internal AI capabilities and knowledge among leadership teams as the biggest risk of deploying these technologies.

AI-powered platforms address this expertise gap through:

Organizations benefit from AI-native platforms that establish professional risk management foundations in compressed timeframes. This is particularly critical for companies preparing for funding rounds, IPOs, or acquisition due diligence, where governance maturity directly impacts transaction success.

Established risk functions face different challenges:

AI enhances existing programs by automating routine tasks, providing real-time monitoring and delivering predictive intelligence.

Integration with existing business systems enables comprehensive risk visibility without replacing functional applications. AI can layer sophisticated analytics over current technology investments, correlating data from ERP systems, compliance platforms and operational databases into unified risk intelligence.

The enhancement approach proves particularly valuable for enterprise organizations managing global operations where manual data compilation across business units creates reporting delays.

Organizations deploying AI for ERM must simultaneously govern AI as a risk itself. "Have a candid assessment of what your board's capabilities are… The board needs to apply an appropriate level of governance pressure to someone who's going to oversee the AI landscape, the risk exposure, the disruption, and the opportunity," says Keith Enright, VP & Chief Privacy Officer at Google and Board Director at ZoomInfo.

Effective AI governance requires clear accountability structures, validation protocols for AI-generated insights and transparent documentation of how algorithms reach conclusions. Organizations should establish AI ethics frameworks, data quality standards and human oversight processes before deploying AI-powered risk tools.

Diligent’s 2025 Risk and Opportunity Outlook emphasizes that implementing ethical frameworks from the beginning of an AI strategy keeps ethical standards at the forefront, regardless of regulatory changes ahead.

AI ethics prove crucial for embedding transparency and accountability that builds user trust in the technology.

Organizations implementing AI for risk management need technology that addresses their specific maturity level and organizational complexity.

The right platform choice depends on whether you're establishing first-time ERM infrastructure or enhancing existing programs with advanced analytics.

For companies establishing risk management foundations quickly, Diligent’s AI Risk Essentials provides the fastest path to professional ERM infrastructure. The platform kickstarts programs in under 7 days through AI-powered peer benchmarking that identifies relevant risks from 180,000+ real-world examples in public company disclosures.

Organizations benefit from training tools, templates and unified workflows that guide teams through risk identification and assessment without consultant dependency.

The rapid implementation timeline proves essential for pre-IPO companies preparing for transaction events or growing businesses demonstrating governance maturity to investors during funding rounds.

AI-powered risk discovery eliminates the challenge of starting with blank spreadsheets, while workflow automation makes ERM accessible and actionable for lean teams managing multiple responsibilities.

Large organizations with established ERM programs require platforms that manage complexity across global business units, integrate with existing systems and provide advanced analytics for strategic decision-making. Diligent ERM centralizes risk management through AI-powered identification, Moody's risk benchmarking data and real-time reporting capabilities.

The platform addresses enterprise-scale challenges:

AI-driven risk intelligence surfaces emerging threats before escalation, while interactive dashboards provide role-specific visibility for different organizational levels. Integration with board management platforms ensures risk intelligence flows seamlessly into board materials and committee reporting.

The comprehensive approach proves particularly valuable for organizations managing multi-jurisdictional compliance, complex supply chains, or rapidly evolving cyber threats where traditional risk assessment cycles cannot maintain pace with business velocity.

Whether you're launching your first ERM program or optimizing existing risk frameworks, the right AI-powered platform matches your organizational maturity and complexity.

Ready to discover how AI-powered risk management transforms governance oversight? Request a demo to see Diligent's ERM solutions in action.

AI automates time-consuming manual tasks, including data collection, risk assessment scoring and report generation. Platforms process 100% of transactions rather than statistical samples, providing comprehensive coverage without proportional headcount increases.

Organizations implementing Diligent’s AI-powered ERM see substantial efficiency gains across maturity levels. Companies establishing first-time programs deploy professional frameworks in 7 days rather than the months traditionally required with consultants.

For enterprises with existing programs, automation delivers measurable resource optimization. Organizations reduce report generation time, accelerate audit cycles, and achieve 50-80% time savings through workflow automation.

Additionally, Diligent ERM customers report 60% cost savings compared to manual risk management.

AI effectiveness depends on quality training data and reliable inputs. Organizations should establish data governance frameworks that define data ownership, validation protocols and quality standards.

Start with high-quality data sources, even if limited in scope, then expand coverage as data management capabilities mature. Many AI platforms include data quality assessment tools that identify gaps and inconsistencies requiring remediation.

Establish human oversight processes where risk professionals review AI recommendations before implementation. Additionally, consider the following:

AI democratizes sophisticated risk capabilities previously requiring large teams or consultants. Platforms designed for smaller organizations, like Diligent’s AI Risk Essentials, provide rapid implementation (7-day deployment), pre-built templates that eliminate custom development requirements and AI-powered benchmarking that identifies relevant risks automatically.

The technology enables lean teams to establish professional ERM programs that satisfy investor expectations without enterprise budgets or specialized expertise.

Schedule a demo to see how Diligent delivers real-time risk insights that boards and executives actually use.