Growing companies face a critical challenge: How do you build compliance processes that scale with growth without slowing down business momentum?

Most scaling organizations discover compliance gaps at the worst possible time:

By then, fixing these gaps becomes expensive and time-consuming. The reality is that manual, ad-hoc compliance approaches don't scale.

According to Diligent's Transaction Readiness Report, 56% of organizations mention resources as their top transaction challenge, while 20% struggle with regulatory compliance during growth phases. What worked when you had 20 employees won't work at 200.

The good news is that professional compliance workflows don't always require enterprise budgets or massive legal teams. With the right approach, you can build scalable processes that grow with your company.

This article covers 10 compliance workflow best practices, including:

When policies live in email threads, regulations get tracked in spreadsheets, and documentation sits across multiple shared drives, you can't answer basic questions:

Centralization means creating a single source of truth for all compliance activities. This includes policies, procedures, regulatory compliance requirements, control documentation, audit trails and evidence of compliance. When everything lives in one system, you actually see what's happening.

Start by mapping your current compliance landscape. What regulations apply to your industry? Which controls do you have in place? Where are the gaps? This assessment becomes your baseline.

Then build your centralized system around three core components:

"One of the clearest gaps I notice is between governance and finance systems. Organizations that close this gap gain speed, credibility and control in transactions — advantages that often determine whether a deal creates value or not," says Jack McCullough, Founder and President of the CFO Leadership Council.

The payoff? When investors or auditors ask questions during funding rounds, you can provide answers immediately instead of spending weeks assembling information.

Manual compliance tracking fails at scale. When you're reviewing regulations quarterly or checking controls monthly, you're always reacting to problems after they occur. Automated monitoring transforms compliance from reactive to proactive. Instead of discovering issues during audits, you identify them in real time and fix them before they become problems.

Smart automation watches for three critical trigger points:

When any of these occur, the system alerts the right people automatically. Implementation starts with identifying your highest-risk areas. Which regulations carry the biggest penalties for noncompliance? Which controls protect your most critical assets? Focus automation efforts here first.

Then layer in continuous monitoring. Rather than periodic checks, automated systems scan for issues constantly. This might include reviewing transactions for policy violations, monitoring access controls for security risks, or tracking regulatory updates for changes affecting your business.

Compliance workflows that work for a 50-person company break down at 200 employees. Tasks take longer, responsibilities get unclear and gaps emerge in your controls. Scalable workflows anticipate growth. Instead of rebuilding processes every funding round, you design systems that expand without major changes.

The key is separating the what from the how. Your compliance requirements stay relatively stable. On the other hand, your workflows should flex as the organization grows.

Start by documenting current workflows with clear ownership and deadlines. Who reviews contracts? How do expense approvals work? What's the process for vendor risk management? Write it down.

Then identify the breaking points. At what headcount does your current approval process become unworkable? When will manual reviews consume too much time? These insights tell you where to invest in automation.

Point-in-time compliance audits create a dangerous illusion. You pass an audit in March, then assume you're compliant until the next review. Meanwhile, controls drift, new risks emerge and gaps develop.

Continuous assessment means checking compliance status regularly and building assessment into your regular operations.

Start with risk-based assessment scheduling. High-risk areas get reviewed monthly. Medium risks quarterly. Lower risks annually. This focuses resources where they matter most.

You can also use technology to support continuous monitoring. Automated controls testing, real-time policy compliance checks and ongoing risk scanning provide constant feedback without adding manual work.

Treating compliance as separate from business operations creates friction. People see compliance as bureaucracy that slows them down rather than as an infrastructure that protects the company.

Integration means embedding compliance requirements directly into business processes so they happen automatically rather than as additional steps. Start by mapping business processes to compliance requirements. When sales closes a deal, what compliance checks are needed? When finance processes payments, what controls must be verified? When HR onboards employees, what training is required?

Then redesign processes to include these requirements natively:

Technology plays a critical role here. Systems that integrate compliance rules into business workflows eliminate the "submit for compliance review" step that creates delays and frustration.

Documentation failures create transaction delays. When investors or auditors request evidence, incomplete records force you to reconstruct history instead of providing immediate proof.

Start by identifying what documentation you actually need. Regulatory requirements define some of this. Investor expectations add more. Transaction readiness requirements complete the picture. This becomes your documentation framework.

Then build documentation into workflows rather than treating it as a separate task. When controls execute, the system captures evidence automatically. When policies change, the system maintains version history. When training completes, certifications are stored centrally.

Organization matters as much as completeness. Documentation should be searchable, accessible and clearly organized by compliance area, time period or requirement type. When someone needs specific evidence, they should find it in minutes, not hours.

"Companies can do a lot of things day-to-day to improve readiness for a potential transaction, many of which would probably make life easier running the company absent a deal," says Rich Mullen, Partner at Wilson Sonsini.

Compliance touches every department, from finance to operations to HR. When teams work in silos, gaps emerge between departments that create real risks. Cross-functional collaboration means building shared understanding and responsibility for compliance across the organization.

Start by mapping compliance responsibilities across functions:

Making these responsibilities explicit prevents the assumption that "someone else" is handling critical requirements. Additionally, create communication channels that connect these functions. Regular compliance committee meetings bring stakeholders together, while shared systems provide visibility across departments.

The collaboration extends to compliance workflow design. When you're building new processes, include representatives from affected departments. This ensures workflows fit how people actually work rather than creating friction.

Regular gap assessments identify where your compliance program falls short before external parties discover these weaknesses. Schedule assessments based on your growth stage and industry. Fast-growing companies should assess quarterly as operations change rapidly. More stable organizations might conduct semi-annual reviews.

Some best practices for compliance gap assessments include the following:

Don't wait for external audits to find problems. Internal gap assessments should surface issues first so you can fix them proactively. This is particularly important before fundraising or M&A activity, when external due diligence will scrutinize your compliance program.

Compliance programs fail when people don't understand their responsibilities. The best policies and workflows can't prevent violations if employees don't know what's required. Ongoing training builds compliance understanding across the organization, but it must be practical and relevant, not just annual check-the-box exercises.

Start with role-based training, as different positions need different knowledge:

Targeted content is more effective than generic programs. Make training continuous rather than annual. When policies change, provide immediate training on updates. When new regulations take effect, explain the implications for daily work. And when issues occur, use them as teaching opportunities.

Finally, build compliance training into onboarding so new employees start with a compliance understanding. This is particularly important for growing companies where headcount increases rapidly and culture needs intentional reinforcement.

Manual compliance workflows don't scale, but not all technology solutions actually help. Many companies implement systems that create as much work as they eliminate.

The right technology reduces manual effort, provides clear visibility and grows with your company. Look for platforms that automate risk detection by scanning documents for legal and compliance issues before they reach investors or auditors.

AI-powered analysis catches potential financial, operational or regulatory implications that manual reviews might miss, providing enterprise-grade oversight without additional headcount.

As you scale across multiple entities or jurisdictions, centralized compliance repositories become essential. Technology should provide a single source of truth for policies, procedures, controls and evidence across your entire corporate structure, dramatically reducing preparation time during due diligence.

Manual compliance tracking simply can't keep pace with rapid growth. The right platform should integrate risk monitoring, automate documentation workflows and maintain transaction-ready materials without requiring constant manual effort.

With this in mind, Diligent's integrated governance platform transforms how scaling companies manage compliance by leveraging AI-powered automation to extend limited resources.

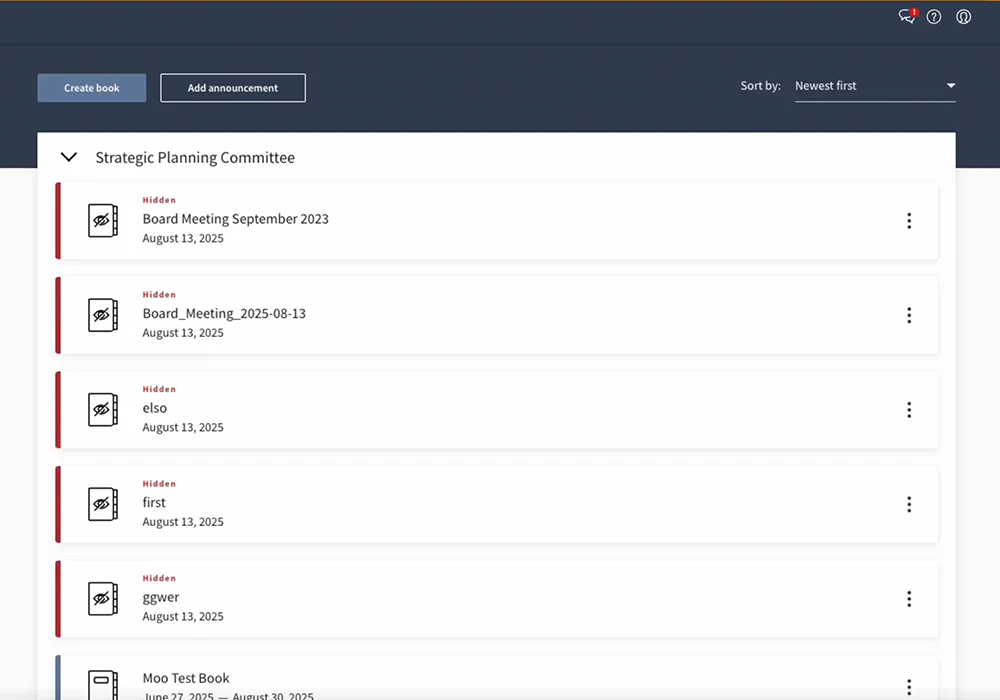

Diligent’s Smart Board Book Builder synthesizes compliance documentation into professional board materials in hours instead of weeks. Growing companies close funding rounds faster when investor-ready materials are maintained continuously rather than rebuilt for each transaction.

Building on this, Smart Risk Scanner reviews documents automatically, identifying legal and compliance risks before they reach your board or investors. For resource-constrained teams, this provides enterprise-grade risk detection without additional headcount.

Additionally, Diligent’s virtual data room capabilities, within the Diligent One Platform, keep governance documentation transaction-ready at all times. When funding opportunities or M&A activity arise, your compliance materials are immediately accessible rather than requiring weeks of preparation.

By centralizing compliance workflows, automating risk monitoring and maintaining investor-ready documentation, Diligent provides the governance infrastructure that scaling organizations need to grow with confidence.

Discover how Diligent transforms compliance workflows for growth-stage companies. See the platform in action.

Compliance workflow automation uses technology to handle repetitive compliance tasks that teams typically do manually. For growing companies, automation provides three critical benefits:

Resource constraints top the list. Growing companies need enterprise-grade compliance but lack enterprise budgets and staffing. This creates pressure to do more with less. Additionally, keeping pace with regulatory changes becomes difficult when teams focus on growth initiatives rather than monitoring regulations. Other challenges include:

Technology addresses many of these challenges by automating workflows, centralizing information and providing scalable infrastructure.

Small teams should focus on three strategies:

The goal is to build systems that scale efficiently while maintaining strong controls.

Ready to transform your compliance workflows for sustainable growth? Book a demo to discover how Diligent provides a transaction-ready compliance infrastructure that scales with your company.