It’s time to bring clarity, simplicity, and security to your board meetings.

Discover why 25,000+ boards and 700,000+ directors

rely on Diligent for their board solutions. Explore our risk-clarifying templates covering compliance, ESG, and beyond. With AI-driven insights and tools, spend less time deciphering data and more time making confident decisions all on one platform.

Discover why IDC calls Diligent a leader in 2025 GRC MarketScape.

Customers

Users

Leaders

Countries

Support

Transform today's risks into tomorrow's opportunities with the Diligent One Platform

Diligent One Platform

- Board reports

- Risk reports

- Audit reports

- Compliance reports

- Reporting best practices

- Benchmarking & insights

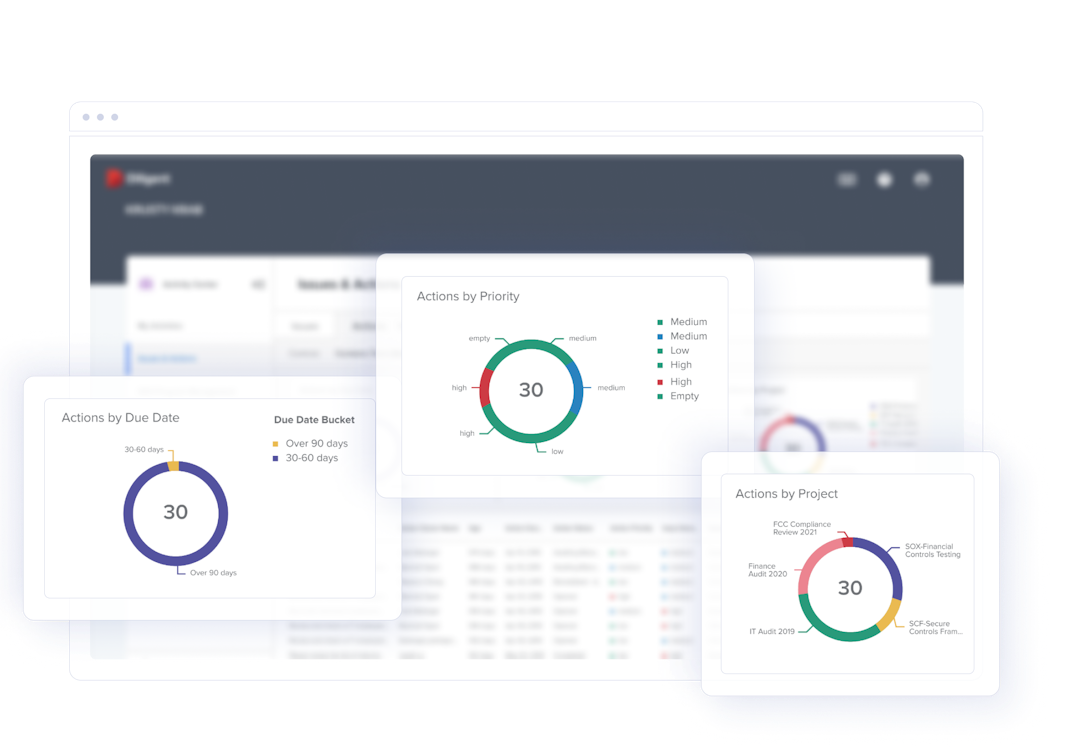

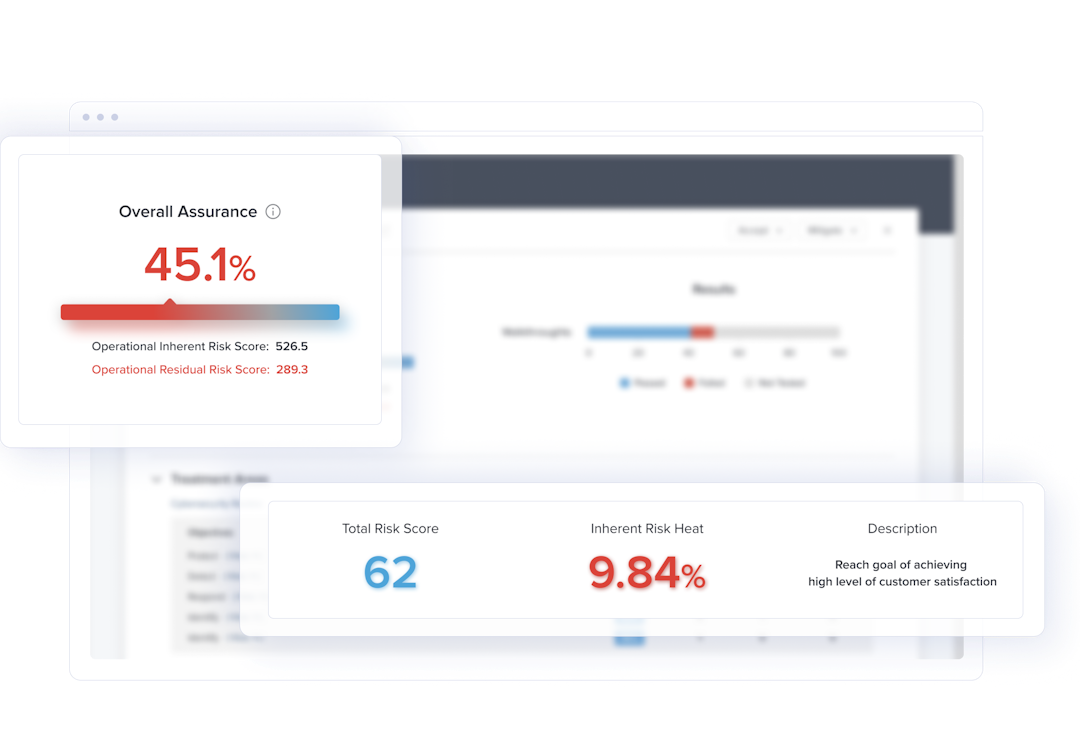

Elevate strategic risk management

Give leaders the insights they need to make more confident, risk-informed decisions — so your organization is ready for anything that comes its way.

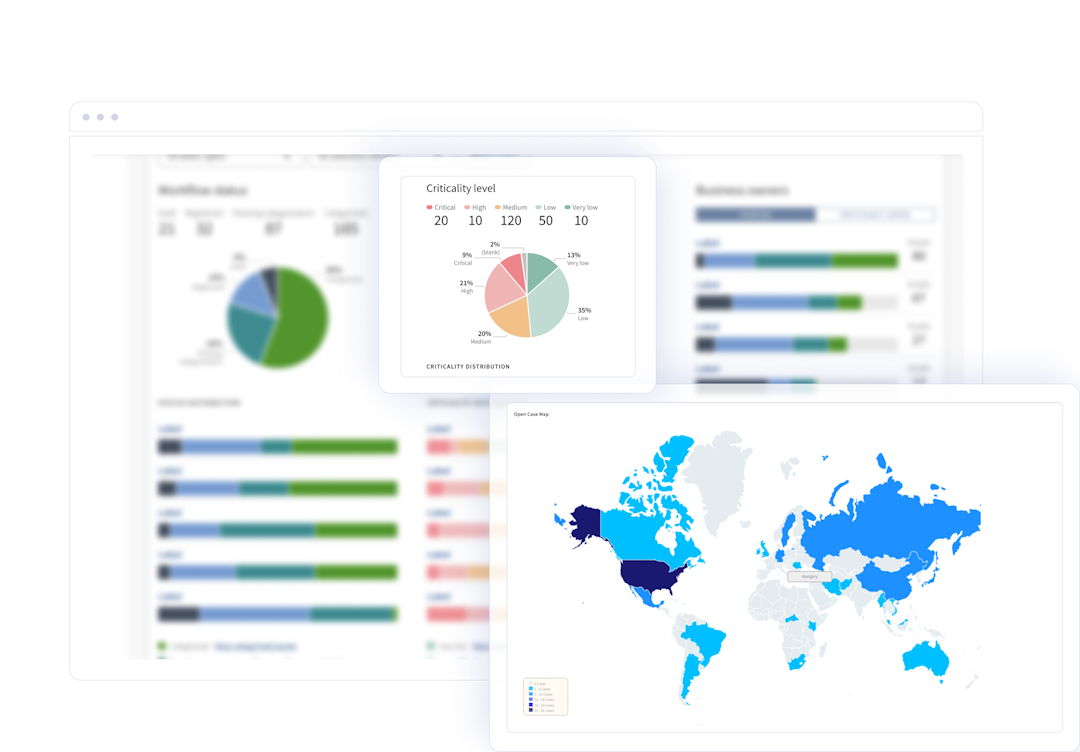

Enable growth

Empower leaders to act quickly and take more ambitious steps that drive growth and create new revenue streams in the short and long term.

Ensure regulatory compliance

Identify and manage risk, and avoid the costly penalties and legal and reputational damages that result from noncompliance.

Don't take our word for it

Customers love Diligent

Ross Surace

Senior Technology Partner, Head Office Functions

“Diligent has removed many, many thousands of pounds of cost from the organization, but it’s the experience that has really driven directors to make the right decisions.”

Related content

AI is here. AI regulations are on the way. Is your board ready?

Your legal team is in the perfect position to help prepare your organization for new AI regulations. Here’s how — and how technology can help.

Stronger consolidation: Elevating your GRC maturity for better risk management

Learn how you can leverage technology to elevate your organization's governance maturity, so you can improve efficiency while transforming risks into rewards.

Your guide to GRC vendor consolidation

Download the free checklist to learn how you can transform your strategy, streamline your operations and elevate your GRC resilience by consolidating vendors today.

The case for purpose-built software: Why tailored programming outperforms modified solutions

Discover how purpose-built software enhances performance and proves more cost-effective than modified solutions in the long run.

We are committed to providing a robust and secure service that protects all our customers’ data.

Diligent’s Security Program is governed based on the NIST Cybersecurity Framework and Diligent follows ISO/IEC 27001 standards to keep information assets secure by implementing an Information Security Management System (ISMS).

Clarity & control for the agile enterprise.

Reach out to our sales team, and we’ll work with you to schedule a demo or conversation.

Security

Ensuring your data is protected is critical to Diligent. Learn how we protect your data.