Where stronger governance meets measurable impact

Make faster, smarter governance decisions

Empower your board and executives with data-driven oversight, streamlining meetings and reporting for faster, more accountable decision-making.

Cut audit prep time and see risk clearly

Accelerate audit preparation by 50% and gain 360° visibility into operational, cyber and vendor risk, all in one dashboard.

Automate compliance, protect your institution

Cut manual compliance tracking by up to 80%, monitor regulatory updates in real time and ensure evidence trails for rapid, regulator-ready audits.

Tackle today’s biggest financial compliance risks — with less effort, more clarity

Streamline board prep and entity compliance with AI

Use AI to build and summarize board materials and surface risk insights, while instantly answering entity questions on ownership, directors and filings, automating document workflows and flagging compliance gaps before they become issues.

Stay ahead of shifting regulations without the stress

Stop chasing constant updates to AML, KYC and data privacy rules. Automate monitoring and alerts so your teams can act instantly. No spreadsheets, no surprises, no penalties.

Cut audit prep from weeks to days

Centralize evidence in secure, role-based repositories tailored for financial audits. Ensure regulator-ready documentation and streamline workflows to eliminate manual effort.

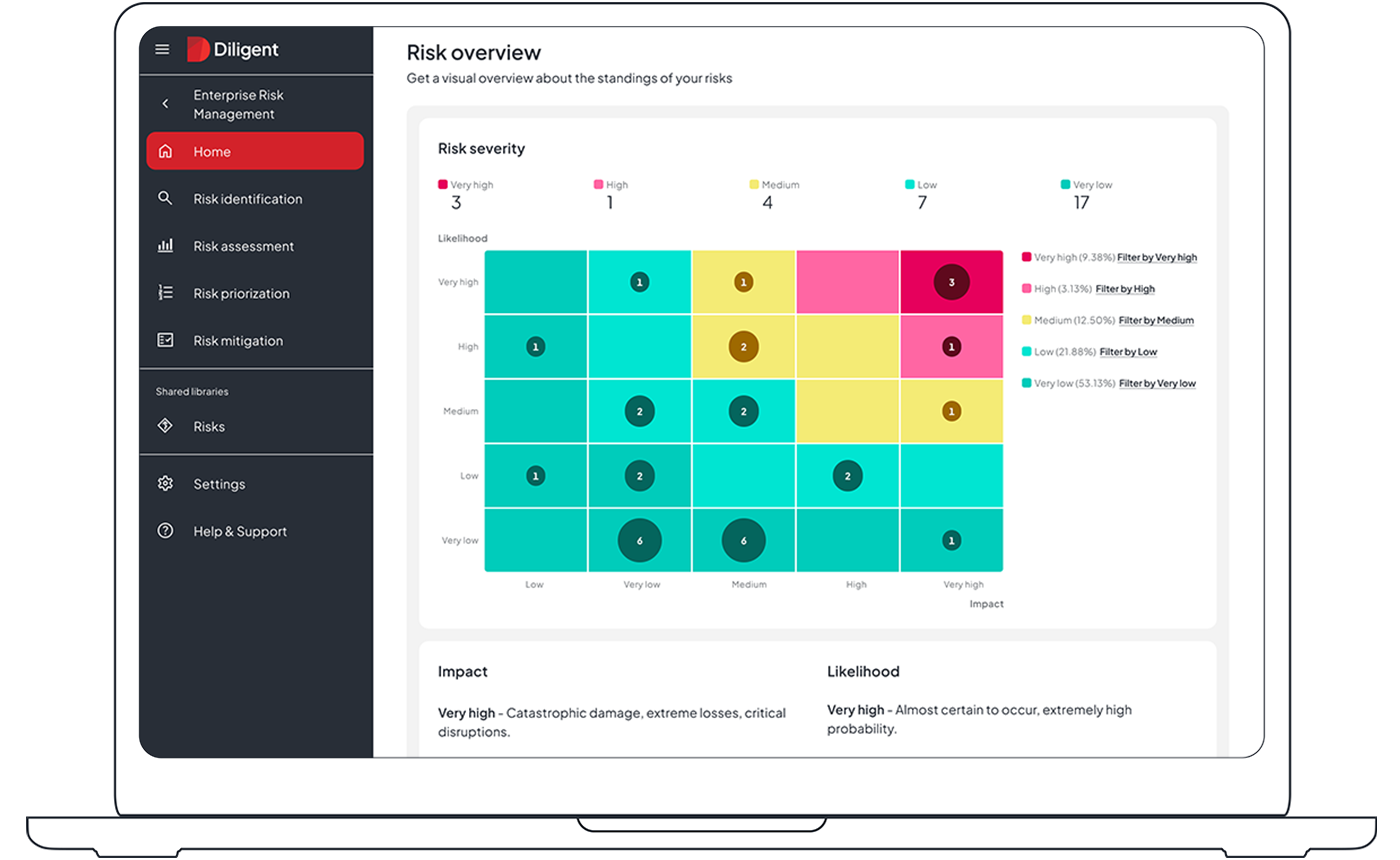

Replace spreadsheets with real-time oversight

Unify risk data across operations, cyber and strategy in one dashboard. Give leaders and regulators instant clarity for confident decisions and transparent reporting.

Why financial services companies love Diligent

“Diligent’s ACL Analytics enabled some of our core competencies to flourish and to use some innovative ways of adding value in a new way that was both effective and efficient.”

Jason A. Gross Vice President of Controls Management Siemens Financial Services Inc.

Turn compliance pressure into competitive strength

Loading form...

Unify your GRC workflows in one AI-powered platform built for financial institutions — so you can move faster, reduce risk and prove results with confidence.

Request a demo