Turn equity & cap table management into a competitive advantage

Prepare for the next step in your company’s growth with software that manages your option plans, ensures cap table accuracy and sets a foundation for raising capital.

Maintain cap table accuracy

Keep your cap table accurate and up to date for easy reporting when it’s time for new funding rounds, convertible notes, warrants and option plans.

Keep equity transparent

Secure top talent and ensure the entire team is in sync with an intuitive portal where employees can view their equity in your company.

Strengthen reporting

Ensure compliance with robust, easy-to-use reporting on a variety of issues. Stay ready for potential investors with an up-to-date cap table, run ASC. 718 reports for tax purposes and more.

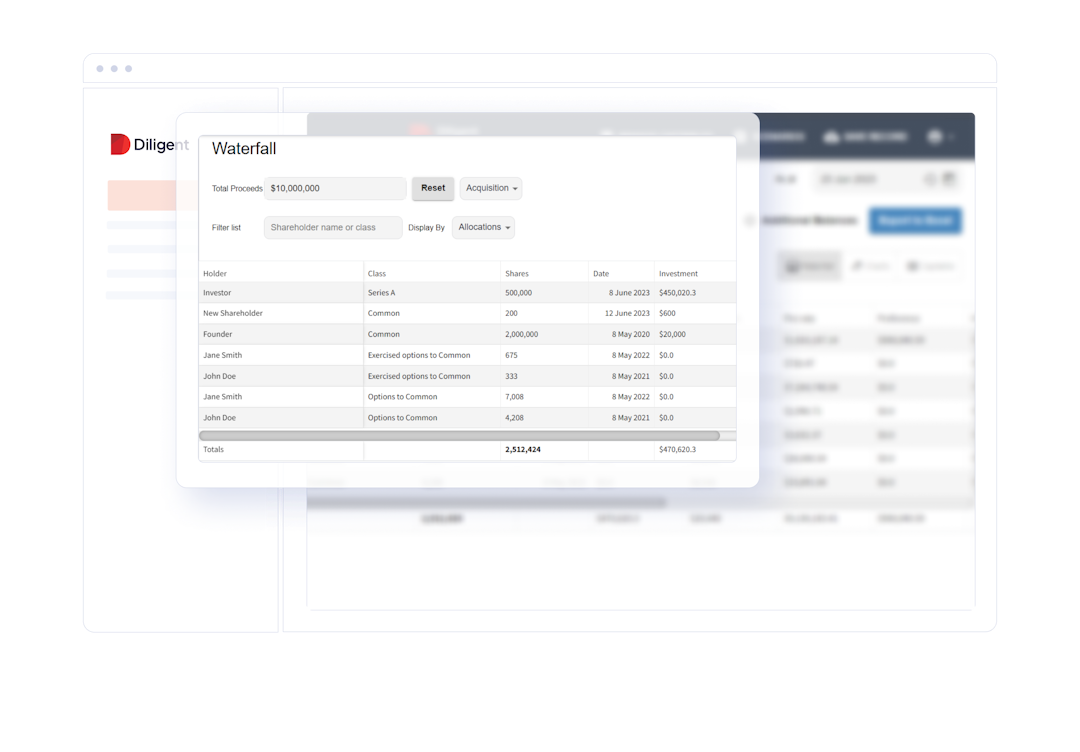

Fine-tune round and exit planning

Leverage in-depth analysis to run various scenarios. See how term sheets will affect ownership. Run exit events to better understand shareholder distribution at different exit values.

Cap table management

Manage stocks, options, warrants and convertible notes. View your cap table in real time. Easily track past versions for a full audit trail.

Option management

Manage option plans, grants and exercises in a single location. Offer employees access to a secure portal where they can view their plans, vesting schedules and documents.

Comprehensive reporting capabilities

Run more than 20 types of reports, including ASC 718 expense and disclosure reports and investment terms. Easily export any report to PDF or Excel.

Blackstone

“Diligent’s world-class software offering is widely trusted by corporate leaders, including several Blackstone portfolio companies.”

Let’s talk.

Does your organization practice best-in-class governance?

Schedule a no-risk demo to see why 700,000 directors trust Diligent to elevate their governance practices.

Let’s talk.

Clarity & control for the agile enterprise.

Reach out to our sales team, and we’ll work with you to schedule a demo or conversation.

Security

Ensuring your data is protected is critical to Diligent. Learn how we protect your data.

We are committed to providing a robust and secure service that protects all our customers’ data.

Diligent’s Security Program is governed based on the NIST Cybersecurity Framework and Diligent follows ISO/IEC 27001 standards to keep information assets secure by implementing an Information Security Management System (ISMS).