Board of directors’ conflict of interest policy

Without a doubt, conflicts of interest are a serious ethics issue that can alter decision-making, undermine board credibility and upset financial planning. Conflict of interest policies are an important part of board director responsibilities. Such policies outline how board directors should avoid conflicts of interest. Boards usually require their board directors to sign a board of directors' conflict of interest policy at the time of their board appointment. However, that only provides partial protection.

Some conflicts of interest are blatantly obvious. Others are so subtle, they're barely noticeable. In most cases, boards need to expand their view of what might constitute a conflict of interest. Board meeting minutes should serve as a record for documenting any actual, perceived or potential conflicts of interest. A board management software program such as Diligent Boards is the best way to document the actions that the board has taken to disclose and resolve conflicts of interest. Diligent Minutes is one of the many software solutions that make up Governance Cloud, a suite of governance solutions for boards.

Where Do Board Director Responsibilities Lie in Relation to Conflict of Interest?

In the United States, shareholders have strong rights. For this reason, board directors are accountable to shareholders. By contrast, in many other countries, board directors have a duty to the company, rather than to the shareholders. In some countries, board directors may be representatives of employees, shareholders and stakeholders, creating an obvious division of loyalties.

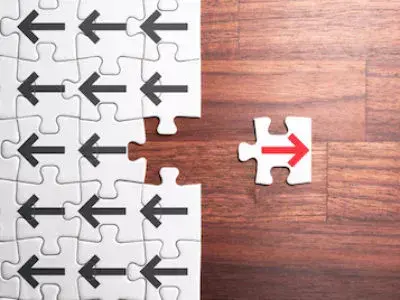

To complicate matters further, the interconnectedness of global interactions makes identifying conflicts of interest even harder and creates greater potential for conflicts of interest, especially when board directors have multiple roles. To further their awareness of conflicts of interest, board directors should be aware of four different types of situations that can set the stage for a conflict of interest.

Four Types of Conflicts of Interest

Integrity and good ethics lie at the heart of preventing conflicts of interest. Carrying that through requires board directors having an awareness of the many possible ways that conflicts could occur and having an action plan for how to address them. Following are four areas in which boards should be on the lookout for conflicts of interest.

- Actual or potential conflicts of interest between the board and the company.

Board directors should never take advantage of their positions on the board. Whether stakeholders are owners or society at-large, boards must never put their own interests first. They must consciously be aware of major conflicts, perks, salaries, insider trading, neglecting board duties and misappropriating assets, among other things, in everything they say or do. In the event of a possible conflict of interest, board directors must act ethically and notify the rest of the board of material facts and take corrective action.

A proactive approach to addressing conflicts of interest is to have a conflict of interest policy in place to address conflicts between the board directors and the company. The board of directors' conflict of interest policy should outline how the board will deal with actual or potential conflicts, such as fraud, misappropriation of assets, poor effort toward fulfilling board duties and insider trading. Boards should insist that all board directors sign the conflict of interest statement and require board directors to declare conflicts of interest at each board meeting.

- When board directors' duty of loyalty to stakeholders or the company is compromised.

Another not-so-obvious conflict of interest pertains to a board director who tries to exercise influence over others through compensation, personal or professional relationship, favors or manipulation. Board directors should be independent thinkers who don't feel forced into agreeing with a dominant board. Board directors need to disclose their relationships with stakeholders upfront. This gives them an opportunity to state in advance who they represent to improve transparency and to avoid a conflict of interest. The boardroom is not the place for egos, rule-breaking, disrespect or toxic behavior.

- When the interests of stakeholder groups aren't appropriately balanced or harmonized.

Conflicts of interest may develop between stakeholders and the company, between different stakeholder groups and within the same stakeholder groups. It's important to balance the intentions of everyone involved in a meaningful, proactive way. Preventing these types of conflicts of interests requires understanding deep-rooted conflicts between stakeholders and the company, as well as subgroups. Stakeholder input is vital to company operations and boards need to be aware of potential conflicts between shareholders, employees, customers, vendors and others.

- Conflicts between the company and society.

This is an area that boards don't often consider or consider well enough. Companies shouldn't act in their own best interests at the expense of society. Companies sometimes make excuses for things like inappropriately bartering down prices, evading taxes, treating employees as commodities and polluting the environment, which place a company in conflict with society. In such situations, boards need to take an ethical stand, commit to duty of care, and make prudent, wise decisions. Future generations could be affected by decisions that today's boards make that harm or compromise societal living.

Final Words on Board of Directors' Conflict of Interest Policy

Good governance begins with board management software by Diligent Corporation, which aids board directors in upholding their moral obligations. Diligent Boards is the base program for agendas and board meeting planning. The platform offers state-of-the-art security so there's no worry over cybercriminal activity. Diligent Boards integrates fully with all the software solutions that comprise Governance Cloud, a complete ecosystem of digital governance solutions. With fully integrated software solutions for meeting minutes, secure messaging tools, D&O questionnaires, board self-assessments, voting, nominations, virtual data rooms and entity management, board directors can manage issues like conflict of interests using one, highly secure platform.

Diligent knows how important convenience is to board directors, so the software designers developed applications where board directors can access all the tools using their tablets and cell phones, in addition to their laptops. Time is money, so Diligent offers top-notch customer service every day of the year, around the clock, by qualified service technicians who are standing by and ready to help. Diligent designed its products by supporting board directors in their quest for good governance. There's no conflict about the quality of Governance Cloud.