Executive director vs. non-executive director

There are multiple differences between executive directors and non-executive directors and there are some similarities that are important to note as well. Considering that there is no legal distinction between them, the differences primarily lie in the expectations for each role. Executive directors and non-executive directors both play important roles, but for very different reasons. One is not more important than the other and one doesn't carry a higher status than the other.

Similarities Between Executive Directors and Non-Executive Directors

Before delving into the differences between executive directors and non-executive directors, it's worth taking a look at the things that they have in common.

Both positions are board-level roles. Executive and non-executive directors have the same liabilities and legal duties. They both have fiduciary duties, which means they must place the best interests of the company ahead of their own interests. All board directors owe a Duty of Care, which means that they must act as any ordinary, reasonable person would under the same circumstances.

Boards of directors are unitary bodies, which means that they make decisions as one. They're required to support all board decisions and to accept board decisions as their own, regardless of whether they voted against or in favor of board decisions.

Differences Between Executive Directors and Non-Executive Directors

When we begin to look at the differences in the roles and the best practices for board composition, it starts to become clear why both roles are so important to good governance.

Executive Director

An executive director is a member of a board or firm who is also an employee of the company and has management responsibilities. Executive directors have executive responsibilities for running the company's day-to-day business activities. They're usually a senior executive or a board member.

Nominating and governance committees usually pick the cream of the crop of the senior management executives to serve as executive members of the board of directors. Their board seat is in addition to their regular managerial duties. Executive board directors sometimes serve as non-executive board directors on other companies. In fact, about 30% of executive directors serve as non-executive directors for other companies. If an executive director serves on the board of a holding corporation, he or she may also serve as a non-executive director on the board of a subsidiary. The only exception to this is if that person had some sort of managerial responsibilities for the subsidiary company.

The executive director role is important because it ensures that the rest of the board receives an accurate representation of management and operations.

Non-Executive Directors

A non-executive director is not an owner or a member of the family of a corporate owner. Professional advisors aren't necessarily non-executive directors; however, professional advisors who are officially appointed as board directors may provide professional advice as a non-executive director who is also a skilled professional.

The value in non-executive directors is that they provide independence and objectivity in their opinions because they have no responsibility for the daily management or operations of the company. Non-executive directors tend to be selected for the skills, talents and abilities they can bring to a board of directors, as well as their personal characteristics. They are also expected to act in the best interests of the company's stakeholders, including shareholders, employees, pensioners and suppliers.

Having independence from the company, non-executive directors are uniquely positioned to challenge, question and monitor the CEO and the senior management team. In this way, they help to hold management accountable.

Non-executive directors also support and mentor the SEO and management team. Non-executive directors also bring an independent perspective to decision-making on important committees, such as the audit, risk, nomination and remuneration committees.

The board awards compensation to non-executive directors, which is usually based on the size of the company, the time commitment and the complexity of the board's activities.

>> Learn More On Our "Modern Governance: The How-To Guide" Whitepaper

Best Practices for Board Membership

The changes in the marketplace have generated some minor changes in best practices surrounding the demographics of board composition. The demand for non-executive directors has increased in recent years. The increased demand for non-executive directors has increased the need for corporations to work on developing business leaders so they can more easily transition to non-executive director roles as they begin to near retirement. Non-executive director roles offer attractive professional development opportunities for pre-retirees and others.

Nominating and governance committees do their best work in recruiting non-executive directors when they first assess the current board's skills, experience and expertise, as well as the need for diversity. Best practices also consider that nominating and governance committees should be forward thinking and should be considering the future needs of the company's leadership when selecting board member nominees.

It's also considered best practices for non-executive board directors to meet collectively without executive directors so they can discuss the performance and actions of executive management without having them present. This practice allows them to speak honestly and freely and without hesitation.

On a global level, boards of directors across the globe learn much from each other and borrow practices, policies and principles from one another. The United Kingdom Corporate Governance Code states that at least half of the board's directors should be independent or non-executive directors, which is a sharp turn from past practices. The Code also states that the board chair should be an independent director and that the chair and the CEO positions should be served by different people.

With regard to remuneration for non-executive directors, the Code states that remuneration policies and practices should be clear, based on risks, comprehensible, and should align with the corporation's culture.

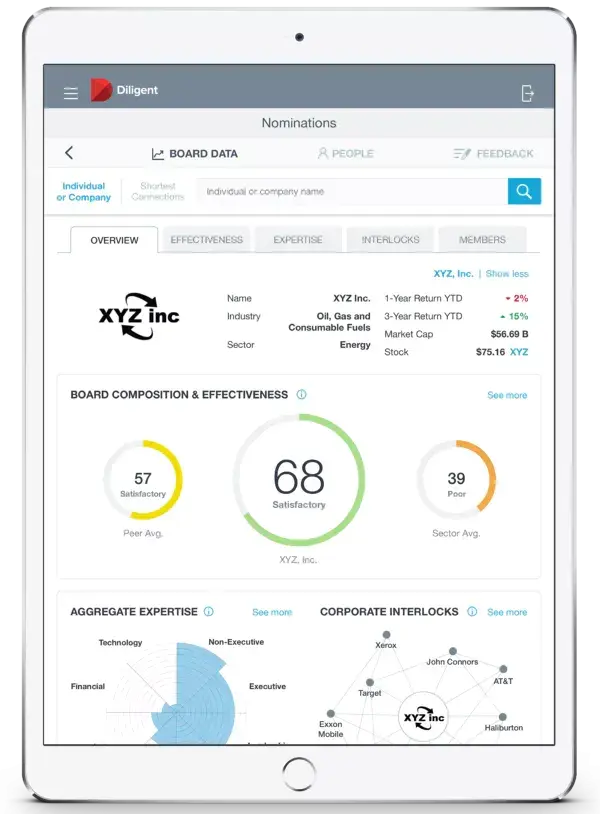

In summary, executive directors and non-executive directors serve different and important roles on a board of directors. Board management software is an important tool that brings both types of directors together for secure collaborations and communications. Diligent Boards has a feature for granular permissions, which provides non-executive directors with the ability to communicate separately from the executive directors as necessary.

Executive directors and non-executive directors can work with board management software such as Diligent Boards and Governance Cloud to support good governance overall.