In February 2021, Jane Fraser became the first woman to lead a major financial institution as she takes the reins of Citigroup, the US's fourth-largest commercial bank. In her 16 years at Citigroup, Fraser has headed several of the firm's departments, including its Consumer and Commercial Banking and Global Consumer Banking divisions. While many celebrated Fraser and Citigroup's role in breaking the ultimate glass ceiling, her appointment also brought attention to the state of gender representation at major American corporations.

Issues like gender bias and pay disparities are becoming central to a company's reputation, but many industries are still struggling to be inclusive and promote women to their top ranks. Despite women comprising the same portion of the overall workforce, top jobs disproportionately go to men. In February, Fraser will become only one of 32 female Chief Executive Officers in the S&P 500, an index where women hold on average only 23.8 percent of all executive positions. Financial institutions like Citigroup have a longstanding reputation as boys' clubs, promoting mostly white men to senior roles. Is this still the case? Using CGLytics board and compensation data, this blog examines the gender representation and pay alignment in the S&P 500's financial sector.

Gender Representation: A Long, Long Way to Go

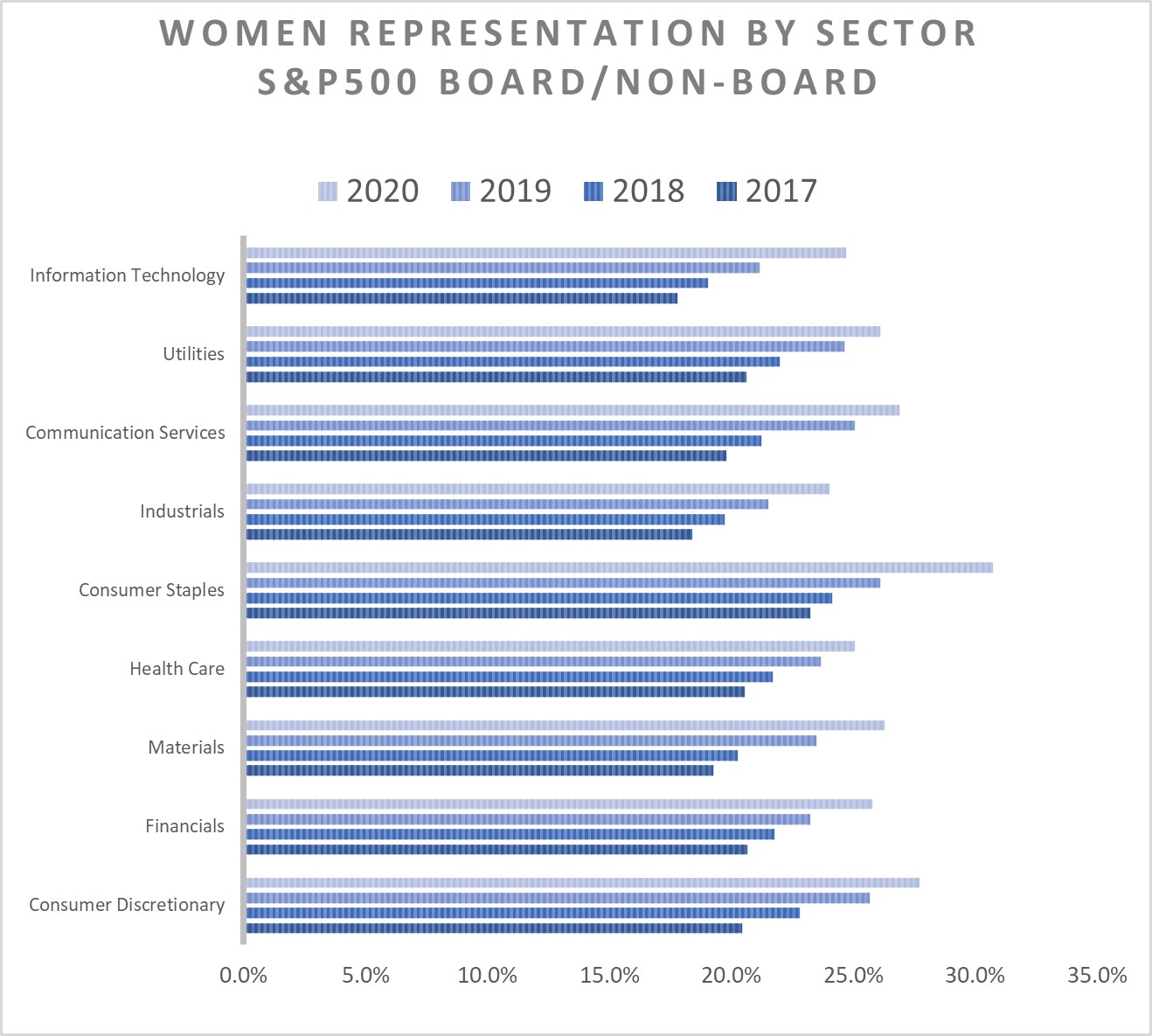

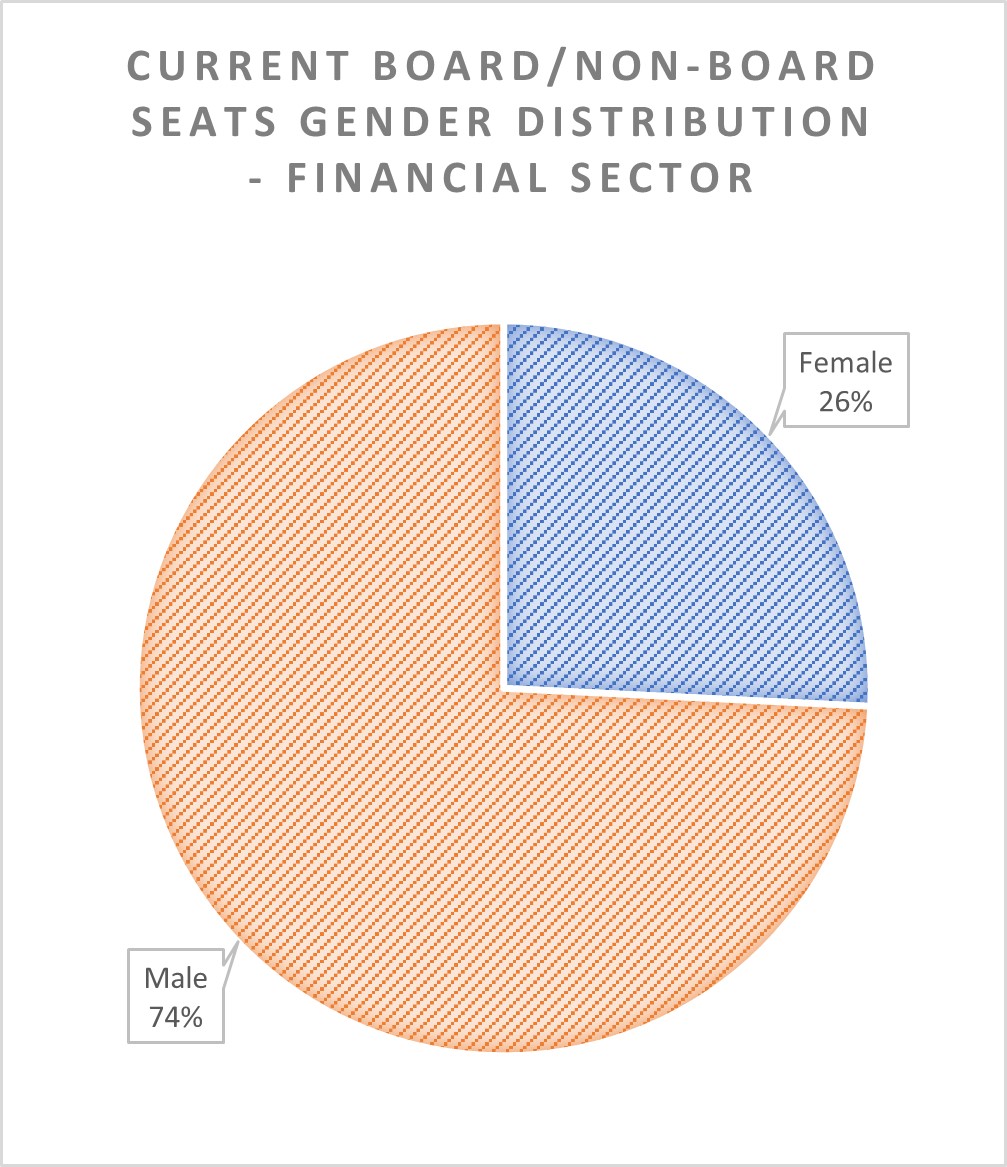

Men currently hold 74 percent of all executive and board roles in the S&P 500. From 2017 to 2020, gender representation has increased year after year in all sectors. But how do financial firms fare against other industries?

Financial companies have only seen a 5.1 percent growth in representation, better only than the health care sector, and have less women in executive positions than five other sectors. The consumer staples sector has seen the largest growth in women representation in the four-year period and, at 30.7 percent in 2020, it is also the one where women hold the most executive roles. It is followed by the consumer discretionary and communication services sectors.

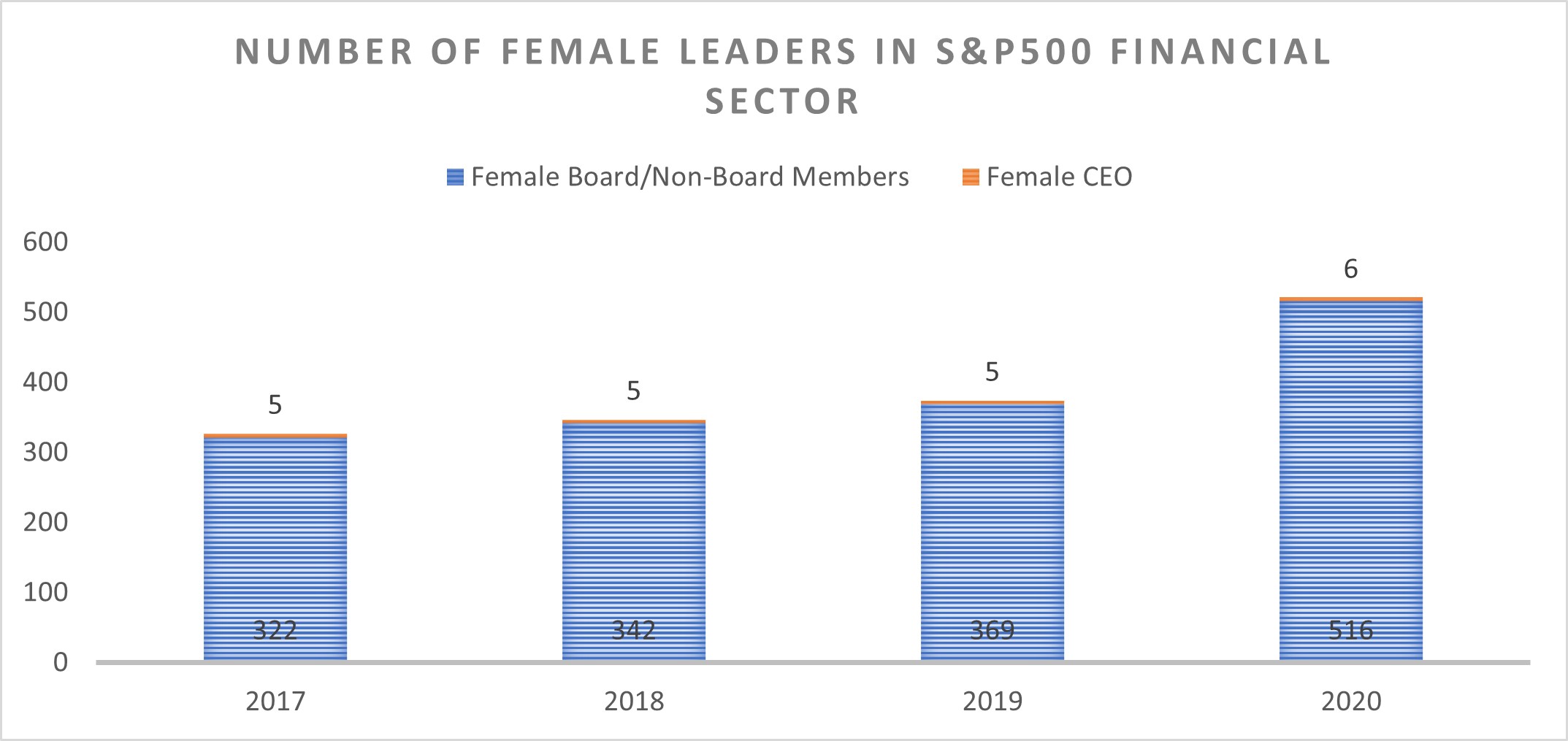

When looking at CEO roles, women in financial services firms are faring slightly better than their counterparts. There is only one female CEO in the energy and materials sectors and two in industrials and utilities. As of 2020, six financial companies have female CEOs: Franklin Resources, Inc., Nasdaq, Inc., Regency Centers Corporation, Synchrony Financial, The Progressive Corporation, and Ventas, Inc. However, these numbers are less remarkable when considering the total number of women holding executive roles in the financial sector.

Out of 522 female executives and board members in 2020, only 6 (1.16%) are CEOs. With 97 financial companies in the S&P 500, only 6.18 percent have a woman in the top position. Female representation is not more promising when considering other executive roles.

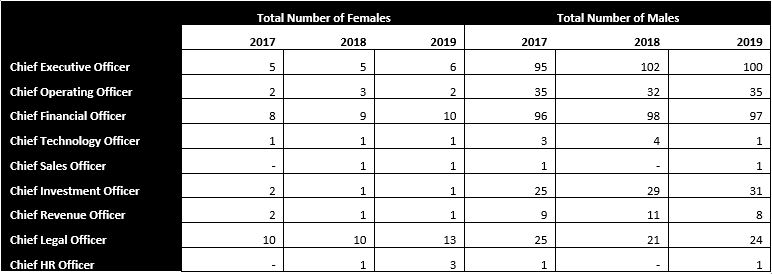

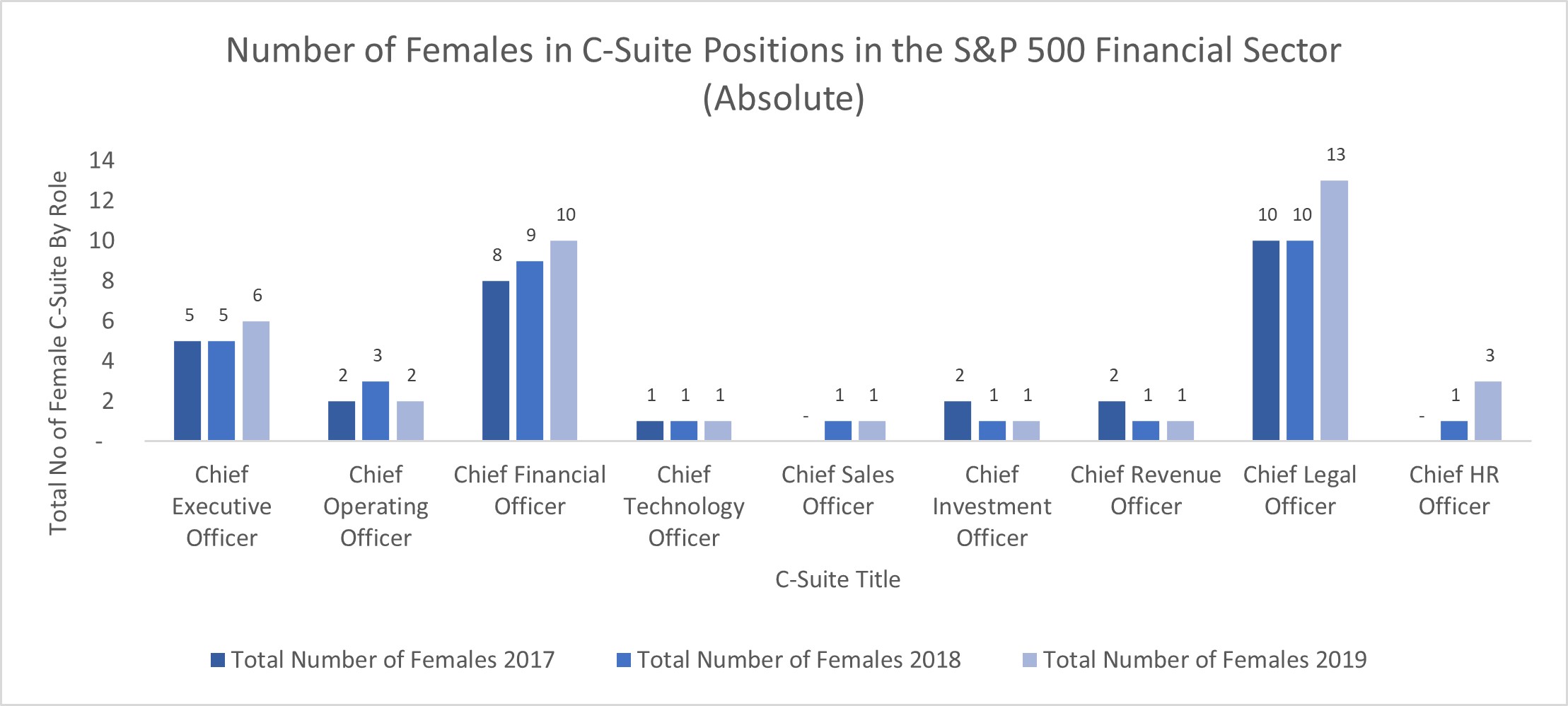

In 2020, there are only two female Chief Operating Officers in the S&P 500's financial sector, down from nine in 2018. Only nine percent of Chief Financial Officers are women. This dearth of female CFOs and COOs is concerning when considering that most CEO candidates typically come from roles in finance and operations. Traditionally, women have higher representation in legal and human resource roles, which are not often recruited for the top executive position. As a matter of fact, Chief Legal Officers and Chief Human Resources Officers have the largest female representation, at 37 and 59 percent respectively in 2020. Overall, the current numbers indicate that the financial sector still has a long way to go to appoint more women in top executive positions.

The State of the Gender Pay Gap

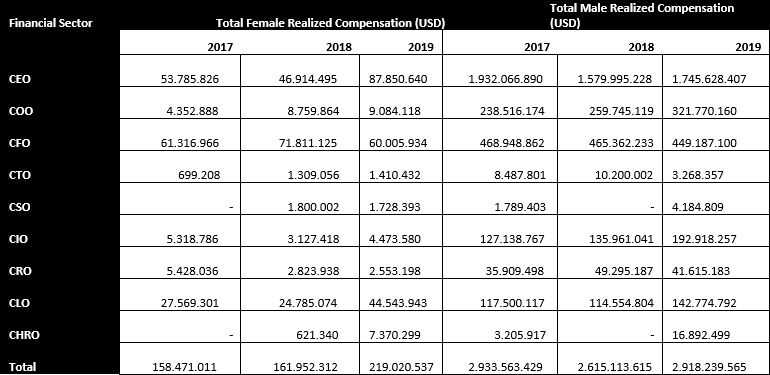

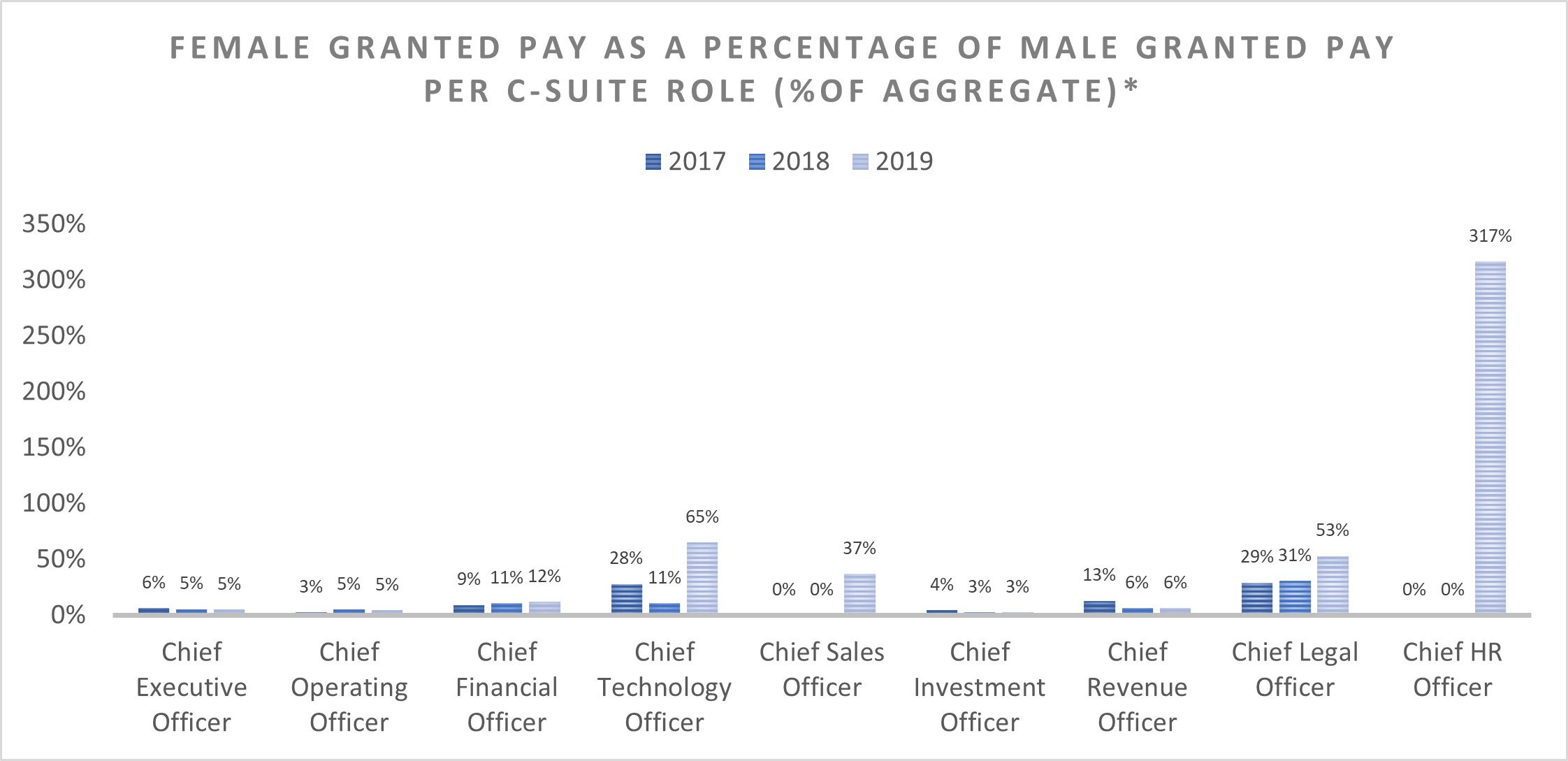

When considering granted pay, the data suggests that the total compensation received by female CEOs in S&P 500 financial sector was USD 70M in 2017, down to USD 63M in 2018 and USD 61M approximately in 2019. In comparison, their male counterparts were awarded total emoluments over USD 1B each in the respective years. From 2017 to 2019, Female CEOs in S&P 500 financial sector awarded pay was only 6% of what their male colleagues granted pay. From 2018 to 2019, the female CEOs earned only 5% respectively of Male CEOs in the financial sector of the S&P 500. Total Granted pay for Female COOs was also 3% of what Male COOs were granted in the financial sector, climbing up to 5% in 2018 and 2019, respectively. For roles such as CLO, where women are known to dominate, the results are still not favorable. In 2019, the total granted compensation of women Chief Legal Officers (CLO) in the financial sector added up to approximately USD 44.5M. Comparatively, their male counterparts earned approximately USD 143M. The data also suggests that in 2019, the total number of women in CLO position in the financial sector was 13 and the total number of men were also 24. This throws out there the disparity in pay between men and women.

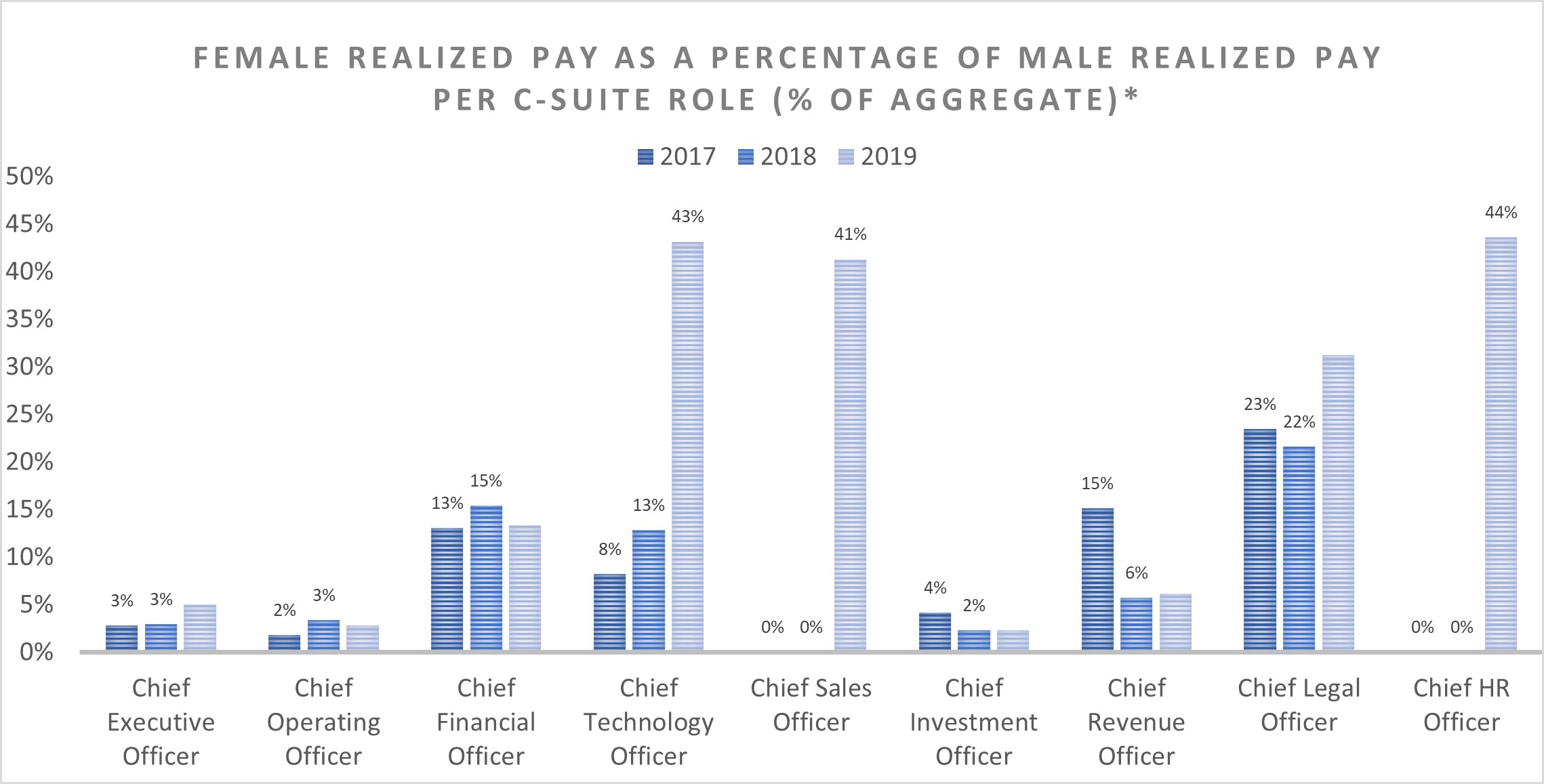

Realized compensation shows an even more troubling picture. In 2019, we find that women leaders in the S&P 500 financial sector in total earned only 8% of what their male colleagues earned. Female CEOs earned only 3% of their male colleagues' emoluments in both 2017 and 2018, respectively. In 2019, female CEOs realized pay improved slightly to 5% of what their male counterparts earned. In the same year, the data suggests that female CHROs in the index's financial sector earned 44% of what their male counterparts earned. It is important to remember that the latter is the position with the highest female representation. There were three women in CHRO positions in the index's financial sector, while there was only one man in the position within the same period.

To a very large extent, we see that for both men and women, granted pay and realized pay were both on an upward for all leadership positions. Realized pay for women increased by 35% from 2018 to 2019. For Male Leaders, their realized pay also grew by approximately 11% within the same period. Nevertheless, this change does not distract from the conclusion that the total pay for women is still far off from their male colleagues. The total granted pay for male and female leaders also climbed by 5% and 24%, respectively, from 2018 to 2019.

Conclusion

Overall, women are vastly underrepresented and underpaid compared to their male peers in the S&P 500's financial companies. While mindsets are shifting and companies are beginning to realize the importance of gender diversity, the progress is not reflected in the numbers. Research on the gender pay gap commonly says that women earn 78 cents to every USD 1 that men make. For women in the US's major financial institutions, even that number may seem unattainable.