Board management is an art. Your board oversees the direction of your organization, but who oversees the efficiency and effectiveness of your board? Adopting board management best practices can help you build the best board possible and equip them to respond to an ever-changing corporate world.

With risks and opportunities evolving faster than ever, boards must closely manage their activities to remain agile, capable and effective. The board management software market is projected to grow to USD 5.56 billion by 2034. This reflects widespread recognition of digital transformation's critical importance in modern governance.

This comprehensive guide covers:

“Whether we know it or not, we all have norms, and norms are just the habits of a group, and when the group functions well, those habits work,” says Lori McKenzie, co-founder of Stanford VMware Women’s Leadership Innovation Lab.

The norms you establish define the practices and behaviors the board will follow. While norms are more informal than a governance model, they are nonetheless a blueprint for how the board will act as a group. Establishing inclusive norms becomes even more important in modern, diverse boardrooms.

"As boards become diverse, the groupthink tends to exclude people and perspectives that are not part of a traditional board structure," McKenzie says. In diverse boards, unspoken habits can unintentionally exclude perspectives that fall outside the traditional boardroom culture. To counter this, agree on a short set of norms, such as:

Boards can break down exclusive structures by intentionally offering each board member an opportunity to share their perspective.

Keeping abreast of board management best practices is a best practice in itself. Digitally savvy boards recognize that issues like cybersecurity need to be at the forefront of their minds. And as shareholder activism goes mainstream, activist investors have become unlikely heroes, driving campaigns that are much more reflective of the world in which companies operate and far more likely to inform board thinking than they were even a year ago.

The regulatory landscape presents unprecedented complexity. The EU's AI Act is entering full enforcement, new state privacy laws are taking effect across eight US states, and cybersecurity regulations are intensifying globally through frameworks like NIS 2 and DORA.

As Christine O'Donnell, Industry Analyst at Verdantix, noted in a recent report on the future of governance, risk and compliance (GRC) technology, good governance is a crucial underpinning for boards in an uncertain world. This good governance creates a strong foundation for effective global oversight and "increases resilience and competitiveness across diverse risk landscapes," both of which are vital to keeping pace with changing regulatory requirements, including the Corporate Sustainability Reporting Directive affecting large EU companies and emerging AI governance frameworks worldwide.

Board directors are never so experienced that they can't benefit from a refresher on familiar topics or training on topics they may be less engaged with.

"You're trying to reinforce [norms] over time," says Jim Meyer, Deputy General Counsel, Corporate Governance at Fannie Mae. "One of the ways you're doing it is you're making everybody aware through education efforts that you may be reboarding existing board members through an annual education series."

While these series can be shorter for existing directors, they should remind them of the board's guiding principles and how they can uphold them.

For example, AI governance, cybersecurity oversight and digital transformation are now critical director competencies in 2026. This means that ongoing education must address technology governance challenges that may not have been board-level priorities years ago.

New directors are either new to the organization, new to serving on a board or both. In all cases, it is essential to integrate them effectively into the boardroom and its culture.

When recruiting new directors, be transparent about behavioral norms and probe whether candidates can contribute to the culture positively. Committees should also consider if a candidate's personal values, experiences and motivations will help the board evolve.

Once the new director is selected, the onboarding process should begin. A well-structured onboarding process helps new directors understand their fiduciary duties, the company's strategy and board practices, enabling them to provide informed oversight and decision-making.

Additionally, onboarding facilitates relationship-building among directors and with management, fostering a collaborative and trusting board dynamic that enhances overall governance. By tailoring the onboarding process to each director's learning preferences and experience level, companies can maximize the value and impact of new directors on board management.

In an episode of Inside Today's Boardroom, Tracy Lee Brown, Director at the PwC Governance Insights Center, asserted, "A robust onboarding program will allow the company to quickly tap into that new director's skills and expertise and also gain their perspectives."

The investment in comprehensive onboarding and sustained mentoring pays measurable dividends: new directors contribute meaningfully to strategic discussions within their first year rather than spending multiple board cycles learning organizational context.

Effective boards function on trust, not hierarchy. Directors must feel comfortable challenging ideas, raising concerns and disagreeing constructively without damaging professional relationships or board dynamics.

Create intentional opportunities for relationship-building beyond formal board business. To pull this off, consider the following:

These interactions build the personal familiarity that enables productive conflict during high-stakes decisions.

Additionally, ground rules for constructive disagreement should be established early in each board cycle. Directors should understand that questioning assumptions, demanding additional data and proposing alternative approaches strengthen decision-making rather than undermine board unity.

The goal is robust conversations that lead to better outcomes, not false consensus that masks unresolved concerns.

When directors consistently interrupt colleagues, dominate discussions, or fail to prepare adequately for meetings, the entire board's effectiveness suffers. In such cases, address issues promptly through private conversations with the board chair or lead director.

Most problematic behaviors stem from misunderstanding expectations, communication style differences, or unfamiliarity with board norms rather than malicious intent. Document patterns and approach conversations with specific examples rather than general concerns.

You should also establish clear escalation protocols for serious violations. Minor issues like over-participation can often be resolved through coaching and clearer meeting facilitation.

However, behaviors that violate fiduciary duties, breach confidentiality, or create hostile environments require formal intervention. The nominating committee should have the authority to recommend the removal of a director when coaching fails to address fundamental conduct issues that compromise board integrity.

Stakeholders are increasingly vocal about the issues they think organizations should prioritize. Proactive stakeholder engagement helps boards anticipate concerns before they escalate into costly proxy battles. It also builds investor confidence through transparent communication and provides valuable market intelligence that informs strategic decision-making.

In fact, experienced non-executive director Ray Troubh believes the "interaction of the large shareholders and the board members should be more frequent."

Universal proxy rules have fundamentally shifted shareholder power dynamics, enabling activist investors to build coalitions and advance proposals with unprecedented efficiency. Boards can no longer treat annual meetings as ceremonial events. Instead, cultivate ongoing stakeholder relationships through regular investor calls, ESG reporting and proactive communication about strategic decisions.

Address stakeholder concerns before they become proxy battles by integrating material issues like environmental impact, executive compensation and governance practices into board discussions throughout the year.

The annual evaluation process reinforces board norms and expectations. Individual evaluations are gaining importance. The National Association of Corporate Directors (NACD) recommends that board evaluations assess both the performance and behaviors of individual directors to strengthen board culture. Use consistent, unbiased frameworks and emphasize confidentiality.

Modern assessments now evaluate directors' capabilities in emerging areas like AI oversight, cybersecurity governance and digital transformation — competencies that weren't board priorities in the past.

Additionally, high-performing boards now approach succession planning with a long-term lens. Instead of filling vacancies with directors who mirror outgoing members, they assess future strategic priorities, identify skill gaps, and recruit to close those gaps.

Economic uncertainty heightens the need for agility. Rather than waiting for crises to emerge, boards should implement practical mechanisms that enable rapid adaptation to changing circumstances.

Establish quarterly "horizon scanning" sessions where boards systematically review emerging risks, regulatory changes, and industry disruptions that could impact strategy within the next 12-18 months.

You can also create pre-approved frameworks for rapid expertise acquisition. This includes:

The days of boards being dominated by a single demographic are changing. Businesses now realize that diversity of thought delivers strategic advantage and is the basis of an ethically sound company, as outlined in a Diligent Institute report.

How do you structure a board? The answer is to provide a diverse range of thinking by developing experience and comfort in engaging in conversations about diversity, equity, inclusion and belonging. Fostering a culture that allows for learning and mistakes without judgment is essential to building relationships across lines of difference.

Explore the benefits of reverse mentoring as a way to leave behind old thought processes. Question whether there are barriers to equality on your board, and ensure your succession planning techniques enable you to build a diverse board pipeline.

Whether this is following best practices in separating the roles of CEO and chair or ensuring a robust audit trail for your board decisions, best practices in governance, risk and compliance should be a vital focus of every board.

Running more effective board meetings is a core element of this governance, ensuring timely information sharing before meetings so that decisions are made with a 360-degree vision and capturing actions to execute all compliance and board duties.

The executive committee can set the stage for productive meetings by deciding in advance how to incorporate key challenges in discussions. This also includes encouraging respectful dissent so you can resolve any lingering concerns.

As corporations face risk from all sides — cybersecurity, fraud and climate change, among others — boards must develop a more integrated view of risk. Rather than waiting until risks arise, successful board management will push directors to identify risk and the opportunities it can present proactively.

Boards that embrace enterprise risk management (ERM) can more clearly define risk-related roles and responsibilities and make more strategic decisions that protect the organization from costly threats.

Assigning board culture to a specific committee ensures accountability and consistency. The nominating and corporate governance committee is a natural choice because it oversees many aspects of board management.

Making an informal directive isn’t enough, though. Modify the committee’s charter to reflect the new role. This should empower the committee to build culture into existing recruitment, onboarding and evaluation processes.

This committee is also well-suited to monitoring governance changes that could impact board culture. The election/appointment of new directors, new committees and changes in leadership can all rock the boat; it’s up to the nominating and governance committee to keep directors aligned with the accepted board norms.

The shift from manual to digital board management represents one of the most impactful governance improvements organizations can make. Cloud-based board management platforms eliminate the inefficiencies, security risks and collaboration limitations inherent in paper-based or email-driven processes.

Traditional manual board management creates multiple friction points. Board administrators spend hours compiling materials from different departments, formatting documents for consistency and managing version control across multiple iterations. Directors receive hundreds of pages of printed materials or PDF attachments scattered across email threads, making it difficult to locate specific information when needed during meetings.

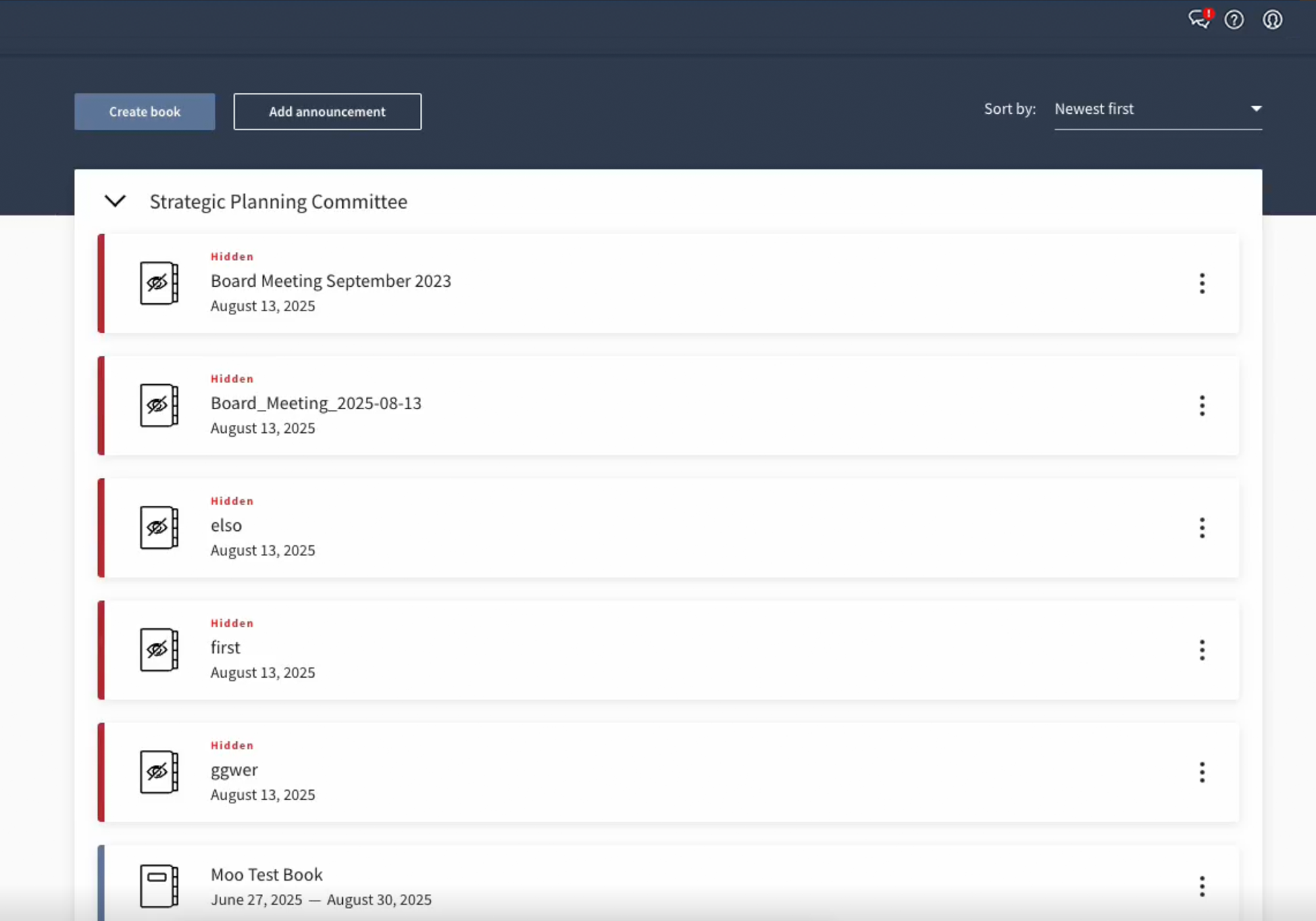

Modern cloud-based board management platforms address these challenges through centralized, secure digital infrastructure:

Consider Aegon, an insurance, pension and asset-management provider headquartered in the Netherlands. Managing over 475 billion of their own and their customers’ investments, Aegon quickly amassed a daunting number of weekly and quarterly board meetings. Preparing for them required long working days and hundreds of pages of print board books with complicated security and versioning protocols.

“At one point, we put materials online using a basic tool, but that did not replace the need for hard copies,” said Henk Snijders, Deputy Company Secretary for Aegon.

Then, they integrated a premium cloud-based solution. Enterprise board management technology from Diligent saved Aegon’s company secretariat a week’s worth of labor over an entire year of board meetings by centralizing the data and collaboration in a single platform.

“It took [the board] a few months to watch everyone else using the iPad-based solution before they were ready to adopt Diligent Boards themselves,” Snijders said. “They never asked for paper again.”

78% of small and medium businesses that use AI believe it will be a game-changer for their company, while 91% report that AI adoption boosts revenue. Boards must oversee emerging technologies and leverage AI to improve their own workflows.

However, generative AI is not yet on the agenda for 45% of boards, representing a potentially significant blind spot in governance oversight. As the EU AI Act enters full enforcement and state-level AI regulations expand across the US, boards need sophisticated AI governance frameworks that balance innovation with regulatory compliance.

AI governance platforms like Diligent now offer board-specific capabilities that transform traditional administrative burdens into strategic advantages:

These AI-powered tools enable boards to focus on strategic oversight rather than administrative tasks. This shift allows for better decision-making in today's complex business environment.

Effective board management requires both behavioral excellence and technological infrastructure. The 15 practices outlined here create the foundation for governance that adapts to emerging risks, leverages diverse perspectives and maintains strategic focus amid complexity.

According to Diligent Institute's What Directors Think 2026 research, 58 percent of directors want less time spent on presentations and more time dedicated to strategic planning. Cloud-based board platforms deliver on this expectation by eliminating the friction that manual processes create while providing the security, collaboration and accessibility that contemporary governance demands.

The gap between digitally transformed boards and those managing governance through email and paper widens every quarter. Organizations that combine intentional board culture with AI-powered governance infrastructure position themselves to lead rather than react in volatile business environments.

Try Diligent to see how the cloud-based platform transforms board management with AI-powered document compilation, automated risk scanning and enterprise-grade security that scales from mid-market to Fortune 500 complexity.

The best cloud-based board management platforms combine robust security, intuitive user experience and comprehensive governance features. Diligent Boards offers enterprise-grade encryption, multi-factor authentication and AI-powered capabilities like Smart Board Book Builder and Smart Risk Scanner, while alternatives like Boardable, BoardEffect and Nasdaq Boardvantage serve different organizational needs.

Cloud-based board platforms use bank-level AES-256 encryption for data at rest and TLS encryption for data in transit. Multi-factor authentication, granular permission controls and comprehensive audit trails protect sensitive governance information while maintaining detailed compliance records. Leading platforms maintain SOC 2 Type II certification and undergo regular third-party security assessments.

Healthcare organizations need governance tools that address HIPAA compliance, quality oversight and complex entity management. Cloud-based board management platforms with healthcare-specific configurations provide secure environments for discussing patient care quality and regulatory compliance.

Real-time information sharing capabilities prove especially valuable when boards need immediate access to quality reports or adverse event documentation.

Organizations seeking alternatives to Boardable should evaluate Diligent Boards, which offers comprehensive security features, AI-powered capabilities and enterprise scalability. Other alternatives include BoardEffect, Nasdaq Boardvantage and OnBoard. The best choice depends on organization size, security requirements and budget.

Transitioning from manual to digital board management requires selecting the right platform, conducting a pilot with engaged directors and providing hands-on training. Phase the transition by starting with board book distribution before expanding to meeting management and collaboration features. Most organizations achieve full adoption within three to six months with proper training and support.

Boards balance technology adoption with security by selecting platforms with SOC 2 Type II certification and regular third-party security assessments. Establish clear usage policies, require strong authentication methods and work with IT and legal teams to ensure platform configurations align with organizational security policies. Modern cloud platforms often provide better security than email-based or paper processes when properly implemented.

Transform your board management with AI-powered cloud platforms. Request a demo to discover how Diligent eliminates manual processes and strengthens governance.