Regulatory change management demands more than periodic reviews and manual processes. Organizations managing operations across multiple jurisdictions face various regulatory changes — from evolving ESG reporting standards and AI governance requirements to industry-specific mandates that shift quickly. A single missed regulation can result in millions of dollars in penalties, damaged stakeholder relationships, and board-level crises that undermine years of progress.

According to Regology's State of Regulatory Compliance in 2025 survey, an overwhelming 92% of compliance professionals report their roles have become more challenging, with nearly half struggling to keep pace with constant regulatory changes. Despite this mounting pressure, approximately 77% of compliance teams remain stuck using manual processes that increase workload and amplify risks.

Meanwhile, regulatory compliance complexity continues to accelerate, with organizations tracking hundreds of regulatory changes annually across different markets, creating an operational strain that traditional compliance approaches simply cannot handle. Organizations that recognize these realities are turning to intelligent automation as the path forward.

This comprehensive guide helps enterprise organizations select and implement regulatory change management software by covering:

Regulatory change management software automates regulatory monitoring, impact assessment, and compliance tracking across multiple jurisdictions and industry frameworks. Unlike traditional governance, risk, and compliance (GRC) tools that rely on periodic manual reviews, modern regulatory change management platforms provide continuous intelligence, enabling proactive compliance management.

These platforms can integrate with existing business systems to aggregate regulatory feeds from government agencies, industry bodies, and legal databases. Through machine learning algorithms and natural language processing, they offer comprehensive regulatory visibility, transforming how organizations manage complex compliance requirements across their global operations.

Traditional regulatory management relied on legal teams manually monitoring regulatory websites, subscribing to regulatory newsletters, and conducting quarterly compliance reviews. This approach created dangerous blind spots in fast-moving regulatory environments, while manual processes struggled to keep pace with the volume and complexity of modern regulatory requirements.

Manual regulatory tracking faces several critical limitations:

Modern regulatory change management platforms address these limitations through continuous regulatory monitoring, automated impact assessment, and intelligent workflow management.

Regulatory change management platforms deliver capabilities that traditional GRC solutions cannot match. While legacy systems focus on documenting existing compliance activities, modern platforms provide predictive intelligence and automated processes that enable a proactive approach. Here’s how:

The global regulatory technology market continues to expand, driven by increasing regulatory complexity and the widespread recognition that manual compliance processes cannot scale with business operations.

QKS Group, a premier market intelligence and advisory firm, projects that the global Governance, Risk and Compliance (GRC) platforms market will grow at a compound annual growth rate of 13.22% through 2030. This growth is driven by organizations' increasing need for more effective compliance technology.

Enterprise adoption continues growing as companies realize these platforms do more than just check compliance boxes. Companies using these systems see fewer regulatory violations, faster response times when rules change, and better relationships with regulators and stakeholders. What started as basic compliance tools has evolved into essential business systems that enable organizations to operate confidently in highly regulated markets.

Effective regulatory change management platforms deliver value through intelligent automation, reducing manual overhead while providing comprehensive regulatory intelligence to support strategic decision-making.

Modern platforms provide continuous monitoring of regulatory developments across multiple jurisdictions, industry frameworks, and regulatory bodies. Real-time regulatory feeds aggregate information from government agencies, regulatory bodies, and legal databases. Additionally, they automatically filter content for organizational relevance based on business operations, geographic presence, and industry classifications.

Advanced natural language processing capabilities can analyze regulatory documents to extract key requirements, effective dates, and implementation deadlines. These systems can parse complex regulatory language to identify specific organizational obligations, exemptions, and compliance timelines that manual reviews often miss or misinterpret.

Intelligence engines provide contextual analysis that explains how new regulations relate to existing requirements. This helps you identify potential conflicts, overlapping obligations, and implementation dependencies that require coordinated responses across multiple business units.

Sophisticated platforms can automatically map new regulatory requirements to existing policies, procedures, and controls. This provides a comprehensive gap analysis that identifies compliance deficiencies before they become violations. These systems maintain centralized repositories of organizational controls mapped to specific regulatory requirements across all applicable jurisdictions.

Cross-jurisdictional compliance management becomes particularly valuable for multinational organizations managing overlapping regulatory requirements across different markets. Platforms can identify where single controls satisfy multiple regulatory requirements while flagging jurisdictions with unique or conflicting obligations that require specialized approaches.

Enterprise-grade platforms provide automated workflow capabilities that:

These workflows ensure consistent response processes while maintaining comprehensive audit trails for regulatory compliance documentation.

Stakeholder notification systems alert relevant personnel when new regulations affect their areas of responsibility, providing context-specific information.

Integration capabilities with existing business systems — including project management tools, document management platforms, and communication systems — ensure regulatory information flows through organizational processes.

Collaborative features enable cross-functional teams to coordinate regulatory responses, share implementation insights, and maintain centralized documentation that supports both ongoing compliance and audit preparation activities.

Advanced analytics capabilities can transform regulatory data into actionable intelligence that supports strategic decision-making and executive oversight. Predictive compliance analytics use machine learning algorithms to identify regulatory trends and anticipate future requirements.

Executive dashboards provide role-specific views of regulatory intelligence, compliance status, and implementation progress tailored to different organizational levels. Board-level reporting capabilities synthesize complex regulatory information into briefings that enable governance oversight without overwhelming board directors with operational detail.

Regulatory change management software delivers advantages beyond basic compliance. This includes operational efficiency, risk reduction, and enhanced stakeholder confidence in organizational governance capabilities.

Organizations implementing comprehensive regulatory change management platforms experience significant reductions in:

Proactive regulatory change monitoring enables early identification and resolution of compliance issues before they escalate into regulatory violations.

Enhanced audit readiness results from continuous compliance monitoring and automated documentation. This provides comprehensive evidence of compliance efforts and regulatory response activities — enabling organizations to demonstrate proactive compliance management to regulators, auditors, and stakeholders.

The predictive nature of AI-enabled platforms enables organizations to anticipate regulatory developments and implement necessary changes before the requirements take effect.

Automation reduces the manual effort required for regulatory monitoring, impact assessment, and compliance tracking, enabling compliance teams to focus on strategic analysis and implementation. Centralized regulatory intelligence eliminates duplicate monitoring efforts across different departments while ensuring consistent interpretation and response to regulatory requirements.

Streamlined workflows create consistent compliance processes across different business units and geographic locations, reducing training complexity while improving compliance consistency. This standardization enhances audit effectiveness while simplifying the management of complex regulatory requirements across enterprise operations.

Regulatory change management platforms transform raw regulatory information into strategic intelligence, informing business planning, risk management, and governance decisions. Executive analytics identify regulatory trends that could affect strategic initiatives, enabling proactive planning rather than reactive adjustments to regulatory developments.

Board-level reporting ensures directors receive comprehensive regulatory intelligence in formats that support effective oversight and strategic guidance. Integration with board management platforms enables the seamless flow of regulatory information into:

The comprehensive nature of these platforms enables organizations to demonstrate sophisticated compliance management to stakeholders, investors, and regulatory bodies. The result? Enhanced confidence in organizational governance capabilities and more support for business objectives.

Organizations use regulatory change management platforms in different ways depending on their size, industry, and regulatory environment. Here are the most common ways enterprise organizations implement these systems:

Organizations operating across multiple jurisdictions face the challenge of managing overlapping regulatory requirements, conflicting obligations, and varying implementation timelines.

Regulatory change management platforms offer centralized oversight of global regulatory developments, while maintaining jurisdiction-specific compliance tracking to ensure local requirements receive the appropriate attention.

Global regulatory monitoring capabilities track developments across all markets where organizations operate, automatically filtering and prioritizing changes based on business operations and regulatory relevance. These systems can identify where regulatory changes in one jurisdiction may signal similar developments in other markets, enabling proactive compliance planning across global operations.

Subsidiary compliance coordination becomes particularly valuable for multinational organizations managing complex corporate structures with varying regulatory obligations. Platforms can track entity-specific requirements while maintaining reporting that provides enterprise-wide visibility into compliance status and regulatory risks.

Different industries face unique regulatory environments that require specialized monitoring and compliance capabilities. Financial services organizations must track developments across securities regulations, banking requirements, and anti-money laundering frameworks that affect different aspects of business operations.

Healthcare organizations manage compliance requirements spanning:

This requires coordinated responses across different operational areas. Additionally, technology companies face emerging AI governance requirements, data privacy regulations, and cybersecurity mandates that require continuous monitoring and proactive compliance planning to avoid regulatory violations in rapidly evolving regulatory environments.

Internal audit functions benefit significantly from regulatory change management platforms that provide:

These capabilities enhance audit quality while reducing preparation time and administrative overhead. Continuous controls monitoring enables audit teams to validate control effectiveness in real-time rather than through periodic testing. Organizations can monitor control performance continuously, identifying exceptions and potential issues before they become audit findings.

Evidence collection automation streamlines the gathering of audit evidence, compliance documentation, and regulatory correspondence that support audit conclusions. Integration with audit management workflows reduces cycle times while improving the quality and reliability of audit processes.

Board members and senior executives require regulatory intelligence that enables effective oversight without overwhelming operational detail. Regulatory change management platforms provide executive dashboards with:

Board-ready reporting capabilities transform complex regulatory data into professional materials that facilitate productive board discussions about regulatory risks, compliance strategies, and resource allocation priorities. Integration with board management platforms ensures regulatory information flows seamlessly into board books and committee materials without requiring additional preparation effort.

Executive visibility into regulatory trends enables strategic planning that anticipates regulatory developments and positions organizations ahead of compliance requirements. This creates competitive advantages through proactive regulatory management.

Choosing the right regulatory change management platform takes careful planning. Here's how to evaluate your options, plan implementation, and avoid common mistakes:

A technical capabilities assessment should focus on regulatory coverage, AI sophistication, and integration capabilities that align with organizational requirements. Organizations should evaluate platforms' ability to:

Security and compliance features require particular attention, given the sensitive nature of regulatory information. Platforms should provide enterprise-grade encryption, detailed access controls, and logging that support regulatory compliance and internal governance requirements.

Finally, user experience and adoption factors impact platform success, particularly for solutions that require engagement from stakeholders across different departments. Intuitive interfaces, mobile accessibility, and role-based customization capabilities ensure effective utilization without requiring extensive training or technical support.

Successful platform deployment depends on structured planning and stakeholder engagement throughout implementation and adoption phases. Stakeholder alignment represents the foundation of successful implementation. This requires engagement from executive sponsors, compliance professionals, legal teams, and operational personnel who will utilize platform capabilities.

Phased deployment approaches reduce implementation complexity, enabling organizations to demonstrate value before a full enterprise rollout. Starting with high-impact use cases builds user confidence and momentum while providing valuable lessons for broader deployment.

Training and support programs ensure users can effectively leverage platform capabilities across different roles and responsibilities. Comprehensive training materials, user documentation, and ongoing support resources facilitate successful adoption among diverse user groups.

Three common mistakes can undermine platform success and return on investment:

Enterprise regulatory change management requires unified technology that connects compliance monitoring, risk assessment, and governance oversight into seamless workflows. This eliminates information silos while providing role-specific intelligence for different stakeholders across the organization.

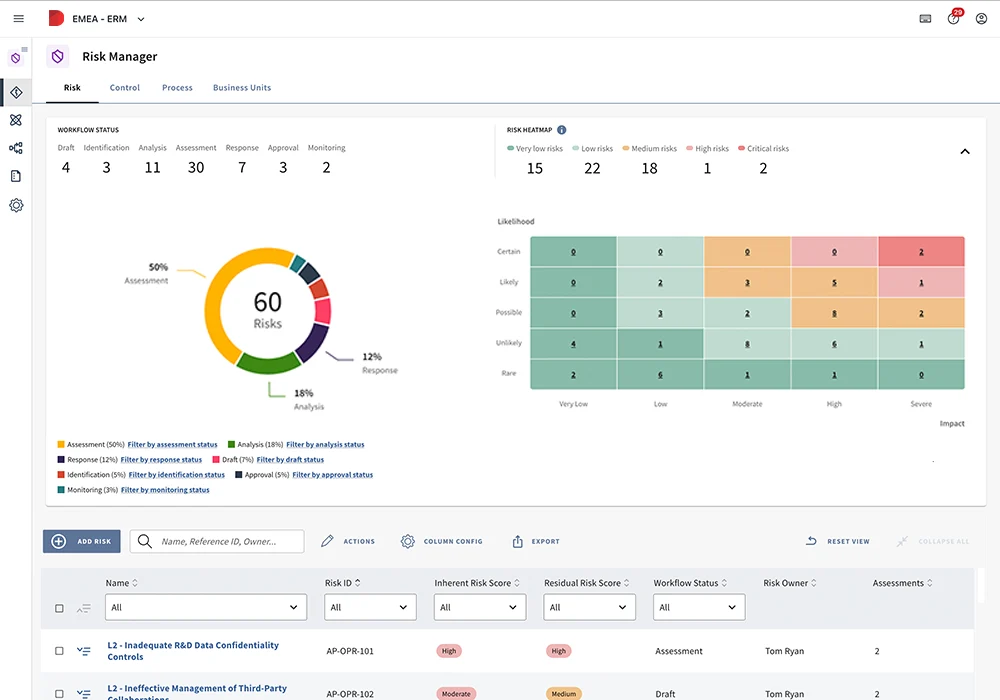

Diligent addresses these challenges through integrated regulatory change management capabilities that transform how organizations identify, assess, and respond to regulatory developments:

Diligent Regulatory Compliance Management centralizes compliance data and monitors regulatory changes across multiple jurisdictions, delivering automated alerts and comprehensive impact analysis that enables proactive compliance management.

The platform's regulatory library provides comprehensive coverage of regulatory developments while automated intelligence engines filter information for organizational relevance and business impact.

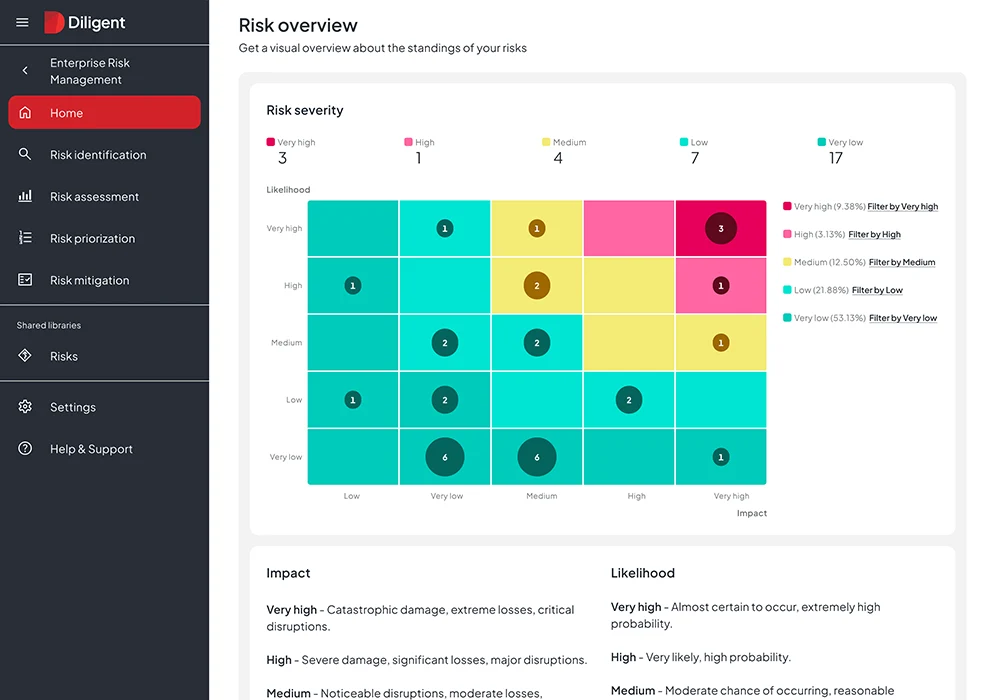

Building on this foundation, Diligent Enterprise Risk Management connects regulatory intelligence to broader enterprise risk assessment, enabling organizations to understand how regulatory changes affect strategic objectives, operational risks, and stakeholder expectations. This integration ensures regulatory compliance and supports overall risk management rather than operating in isolation.

To enhance these capabilities, Diligent ACL Analytics delivers innovative AI modules for parsing regulatory content, summarizing updates, and benchmarking risk disclosures that enable organizations to leverage artificial intelligence for proactive compliance and regulatory trend analysis. These capabilities provide strategic intelligence that traditional manual monitoring cannot match.

The Diligent One Platform provides unified GRC capabilities that integrate regulatory change management with board management, risk assessment, audit activities, and ESG reporting. This comprehensive approach eliminates data silos while streamlining regulatory compliance as part of holistic governance oversight.

Supporting these integrated workflows, Policy Manager centralizes regulatory requirements, maps controls to mandates, and automates policy review processes that ensure continuous alignment across multiple teams and jurisdictions.

Additionally, Internal Controls Management leverages AI to analyze regulatory updates, detect control gaps, and suggest relevant controls that automate remediation activities while supporting audit readiness.

These tools provide the procedural infrastructure needed for effective regulatory change management.

Ready to transform your regulatory compliance with AI-powered automation and comprehensive governance integration? Schedule a demo to discover how Diligent delivers regulatory intelligence that drives business success.

Regulatory change management software continuously monitors regulatory developments, automatically assesses business impact, and streamlines compliance workflows across multiple jurisdictions. Unlike traditional GRC tools that rely on periodic manual reviews, modern platforms deliver real-time regulatory intelligence and automated compliance processes.

Traditional GRC systems focus on documenting existing compliance activities and managing periodic assessments, while regulatory change management platforms provide predictive intelligence that enables proactive compliance management.

Essential capabilities include continuous regulatory monitoring across relevant jurisdictions, AI-powered impact assessment that identifies business relevance, automated compliance mapping that connects requirements to existing controls, and comprehensive workflow management that ensures consistent response processes.

AI-powered analytics enable organizations to monitor comprehensive regulatory sources rather than limited manual tracking, identifying patterns and regulatory trends that inform strategic compliance planning. Real-time monitoring provides early warning systems for regulatory changes, while machine learning algorithms continuously improve the accuracy and relevance of regulatory intelligence.

Automation reduces manual effort while improving consistency and accuracy of compliance processes. Organizations benefit from faster regulatory response times, reduced compliance violations, and enhanced stakeholder confidence.

Common implementation challenges include inadequate stakeholder alignment, insufficient change management, and over-customization, which creates maintenance complexity. Successful implementations require executive sponsorship, comprehensive training programs, and phased deployment that builds organizational confidence and user adoption.

Organizations should establish clear success criteria, maintain realistic timelines, and integrate platform capabilities with existing workflows rather than creating parallel processes. Data governance standards and validation procedures must be established before deployment to ensure platform effectiveness and user confidence.

ROI measurement should focus on reduced compliance violations, faster regulatory response times, decreased manual effort, and improved audit efficiency.

Quantitative metrics include reduced compliance penalties, decreased audit preparation time, and improved regulatory examination results. Qualitative benefits include enhanced executive visibility into regulatory risks, improved board oversight capabilities, and stronger stakeholder confidence in organizational governance.

Ready to modernize your regulatory compliance approach? Request a demo to explore how Diligent can transform your regulatory change management.